Highlights

- Sturdy weekly U.S. efficiency on account of a straightforward Easter comparability over final 12 months.

- Publish-Easter efficiency similar to final 12 months.

- Group demand nonetheless brilliant together with particular occasion impacts, such because the photo voltaic eclipse.

- Worrisome March efficiency indicators warning for remainder of the 12 months.

U.S. Efficiency (31 March – 6 April 2024)

Weekly U.S. outcomes have been sturdy with income per obtainable room (RevPAR) rising 6.9% 12 months over 12 months (YoY) through features in occupancy (+2.9 proportion factors [ppts]) and common day by day price (ADR, +2.1%). This week’s robust RevPAR development got here from a straightforward comparability to final 12 months on account of a shift within the Easter observance, which occurred per week later in 2023. In consequence, the weekend (Friday & Saturday) drove weekly outcomes with RevPAR development of 26.1%. Weekday (Monday – Wednesday) and shoulder (Sunday & Thursday) intervals have been down in combination as they started the week with Easter Sunday 2024. Efficiency improved from Wednesday as the straightforward Easter 2023 comparisons materialized.

It’s straightforward to dismiss the week as a result of straightforward Easter comparability, nevertheless, offsetting the comparability to the identical post-Easter week final 12 months, the trade held up somewhat effectively regardless of ongoing weak point within the decrease segments of the trade.

A 12 months in the past, RevPAR was up 8.6% versus 6.9% this 12 months. The distinction was on account of decrease ADR features (2.1% TY vs. 4.7% LY). Occupancy grew sooner this week however ended up at almost the identical stage because it was a 12 months in the past (64% TY vs. 64.1% LY). Demand development was increased this 12 months, significantly over the weekend, which we attribute to journey for the entire photo voltaic eclipse. In consequence, this 12 months’s weekend RevPAR development was increased than final 12 months. On the regarding aspect, weekday and shoulder journey was higher within the week after Easter in 2023 on account of flat ADR. Final 12 months, ADR development in these two intervals was nearer to the speed of inflation.

Group demand a brilliant spot

Group demand bounced again after the Easter week stoop, growing 22.1% week over week and up 33.3% YoY. When evaluating matched post-Easter weeks, group demand was down 6.1% YoY which was one of many first instances group demand declined this 12 months. Group ADR elevated a wholesome 9.6% YoY and +3.8% when in comparison with the matched week.

Market efficiency lifted by sporting occasions and journey for the photo voltaic eclipse

The NCAA Males’s Remaining 4 and WrestleMania 40, drove Phoenix and Philadelphia to steer the Prime 25 Markets, as RevPAR rose greater than 35% YoY in each markets. And with the straightforward comparisons, weekend RevPAR elevated greater than 100%. Adjusting to the identical post-Easter week final 12 months, Phoenix was the large winner with RevPAR up 77% over the weekend and 35% within the full week, as ADR rose 25%. Outdoors the Prime 25 Markets, the best RevPAR acquire was seen in Cleveland, OH (+59.2%), which hosted the NCAA Girls’s Remaining 4. Des Moines, IA (+53.1%), which hosted a number of youth sports activities occasions, and Indianapolis, IN (+51.2%), adopted. Cleveland and Indianapolis have been additionally within the direct path of the photo voltaic eclipse.

U.S. Efficiency (preliminary March 2024)

The primary quarter of the 12 months has seen a lot decrease RevPAR development than anticipated. We anticipated the quarter to be barely weak given the robust efficiency seen final 12 months, however it was softer than projected . Specifically, March was a lot weaker than we anticipated as illustrated by the preliminary estimates beneath.

We might level to the truth that this March had 5 Sundays versus 4 final 12 months, and the fifth Sunday was Easter Sunday – historically a really weak efficiency day. Nonetheless, in case you simply have a look at the month the place each years are matched (Friday, 1 March 2024 to Friday, 29 March 2024; in comparison with Friday, 3 March 2023 to Friday, 31 March 2023), you will note that the month was mushy regardless past the fifth Sunday. For these 29 days, RevPAR was down 1.5% on account of falling occupancy.

It’s probably that lower-to-middle earnings vacationers are being squeezed out of journey as a result of continued rise in costs, elevated debt, and servicing prices. This has led to the tip of pent-up demand, which isn’t being offset by sturdy enterprise and worldwide journey. The lower-tier segments are being impacted greater than the higher tier, which continues to learn from elevated group journey.

- RevPAR: -2.2%, first lower since February 2021.

- Demand: -2.7%, has fallen in 12 of the previous 13 months.

- ADR: +0.2%, smallest acquire since March 2021

- Chain Scale RevPAR: All down, ranges from -0.4% (Higher Upscale) to -7.2% (Financial system).

- Chain Scale Demand: Luxurious and Higher Upscale, +8.3% and +1.8%, respectively. All others down from -1% (Upscale) to -6.0% (Financial system).

World trade coming into subsequent section of restoration?

Many of the largest international nations noticed RevPAR decline as effectively, which is in step with previous years and the Easter vacation. Whereas RevPAR was down in Mexico, it noticed the most important occupancy improve, with the most important features being within the markets within the northern and central components of the nation that have been within the path of the photo voltaic eclipse. March general was typically optimistic, nevertheless, the subsequent few months will begin to mirror extra steady patterns because the pandemic is totally gone from all year-over-year comparisons.

Wanting forward

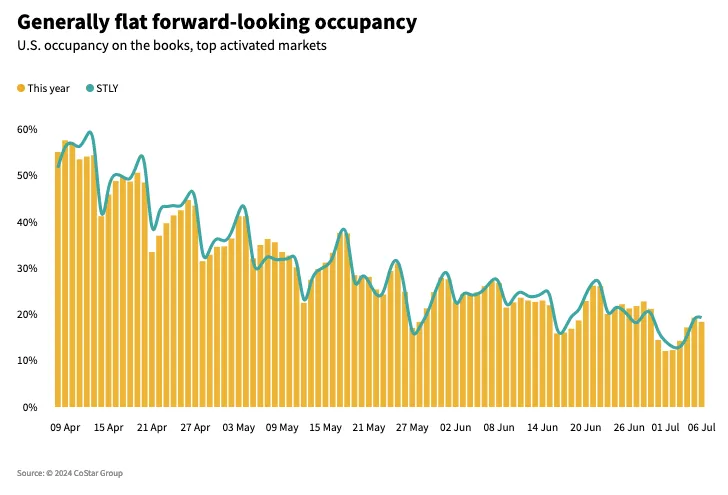

The U.S. lodge trade ought to see higher development in April with tailwinds from Easter 2023 and the photo voltaic eclipse, together with continued robust group demand. Headwinds embrace the Passover observance in late-April that can gradual some group journey together with the shortage of an April spring break season as a result of early Easter observance. Final 12 months’s Taylor Swift tour from mid-March by means of August boosted journey alongside the trail of the tour and will probably be missed this 12 months, leading to some softness in choose markets. Nonetheless, journey for occasions, concert events, sports activities, and festivals stay a powerful demand driver however we do count on vacationers to be extra selective than they have been a 12 months in the past. As of now, summer time remains to be anticipated to be extra sturdy than final 12 months.

Globally, the trade seems to have reached its normalization interval. Double-digit RevPAR features have light away and can now solely seem amongst particular occasions. Together with the 2024 Paris Olympics, a number of markets in Europe will profit from the “Taylor Swift impact” as her tour begins up subsequent month in France and runs by means of the summer time, ending in London in August.

This text initially appeared on STR.