Prior analysis carried out by CBRE Motels Analysis revealed that lodge administration corporations had been rewarded handsomely because the U.S. lodging business recovered from the COVID-19 pandemic. An evaluation carried out by CBRE in April 2023 discovered that complete lodge income elevated by 153 % from 2020 to 2022, whereas gross working income (GOP) grew by 437 %. This resulted in a 68 % improve within the charges paid to administration corporations and introduced administration charges again to pre-pandemic ranges. The will increase in charges had been largely as a result of improved efficiency of U.S. lodging properties, which in flip triggered the fee of incentive administration charges.

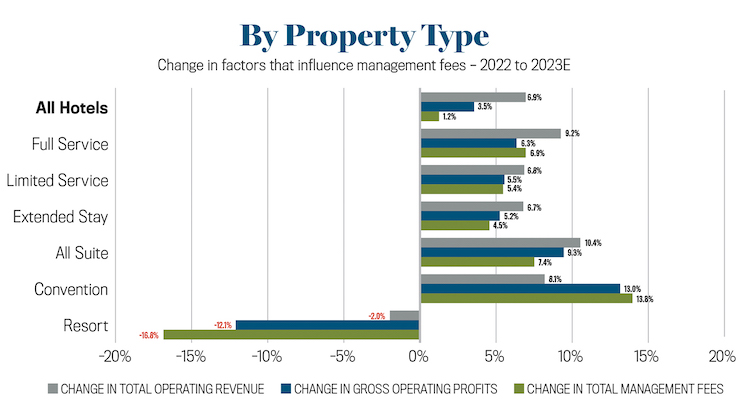

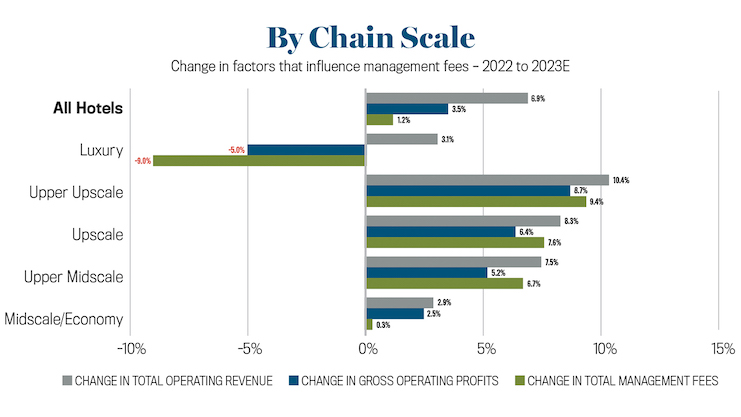

As U.S. lodging business efficiency decelerated in 2023, so did the quantity of charges paid by house owners to their administration corporations. Preliminary outcomes from CBRE’s annual Traits within the Lodge Trade survey discover that complete lodge income development slowed to six.9 % in 2023, whereas GOP inched up by 3.5 %. Because of this, complete administration charge funds rose by simply 1.2 % in the course of the yr, nicely under the double- and triple-digit development charges seen within the earlier two years.

To achieve a greater understanding of how and why administration charge funds decelerated in 2023, CBRE analyzed the efficiency of 1,445 U.S. lodges that reported administration charge funds in each 2022 and 2023. In 2023, this preliminary pattern averaged 162 rooms in measurement and achieved an occupancy degree of 70.2 %, together with an ADR of $195.65.

Variation by Property Sort and Chain Scale

Administration contracts are structured to reward administration corporations for superior efficiency. Conversely, when efficiency ranges decline, so does the compensation to the administration firm. The variances in modifications in administration charges from 2022 to 2023 grow to be very evident when analyzing the information by property kind and chain scale.

In 2023, complete revenues and GOP elevated for all property varieties within the CBRE pattern besides resort lodges. You will need to notice that a big part of CBRE’s pattern of resort properties operates within the luxurious chain-scale section. The pattern of resorts achieved an ADR of $604.65 in 2023, down from $649.13 in 2022. As a result of decline in ADR, complete revenues for the resorts dropped by 2 % in the course of the yr, which resulted in a 12.1 % drop in GOP. With income and income each declining, administration charges for resort operators decreased by 16.8 %.

To supply some context for the luxurious chain-scale resort sector, you will need to notice that resort lodges carried out surprisingly nicely in the course of the pandemic. As markets around the globe reopened, many U.S. vacationers opted for leisure journey overseas throughout 2023, which lessened resort demand (maybe quickly), leading to extra aggressive room charges and efficiency.

Among the many different property varieties, conference lodge operators loved the best improve in administration charges as group demand in giant cities elevated. Most of those properties function within the upper-upscale section. In 2023, the restoration of group demand precipitated conference lodges to expertise an 8.1 % improve in revenues, together with a 13 % uptick in GOP. Given these important features, conference lodge administration charges grew by 13.8 % from 2022 to 2023—probably the most of any property kind.

Administration charge modifications for different property varieties are much like the relative tempo of restoration from 2020. After lagging in restoration, full-service and all-suite lodges (upscale and upper-upscale) exhibited comparatively robust features in revenues and income throughout 2023, as enterprise vacationers continued to reenter the market. Consequently, administration charges for these two property varieties elevated by 6.9 % and seven.4 %, respectively, in 2023.

Usually, economic system, midscale, and upper-midscale limited-service and extended-stay lodges oriented towards leisure vacationers led the lodging business restoration in 2021 and 2022, and the tempo of restoration naturally slowed down in 2023. Accordingly, the administration charges paid at these property and chain-scale classes elevated the least in the course of the yr. From 2022 to 2023, limited-service administration charges rose by 5.4 %, whereas extended-stay funds grew by 4.5 %.

Throughout all chain scales, administration corporations proceed to be keenly conscious of the battle to enhance income. The scarcity of labor, growing prices for all sources, and the necessity to management flex and circulate bills are all components that should be thought of when making an attempt to extend profitability.

A Rollback in Incentive Charges

Incentive administration charges are paid to administration corporations to make sure they’re aligned with the proprietor’s have to develop income, not simply income. Subsequently, with the tempo of revenue development slowing down, we have now seen a commensurate deceleration within the worth of incentive charge funds.

CBRE analyzed a subgroup of 80 lodges that reported paying an incentive administration charge in each 2022 and 2023. Amongst these 80 properties, 34 reported a decline in incentive administration charge funds. At these 34 lodges, income development was 4.1 %, however GOP elevated by simply 0.1 %. This resulted in a 4.9 % discount within the incentive charges paid to the administration corporations from 2022 to 2023.

However, the administration corporations on the remaining 46 lodges benefited from a 4.1 % improve in administration charge revenue. The lodges they function loved a 7.7 % improve in complete income together with a 4.5 % rise in GOP in 2023. No matter efficiency, incentive charge funds had been made most frequently at conference, resort, and luxurious lodges, which means they’re much less widespread within the administration contracts for decrease priced limited- and select-service lodges.

Administration Charges Work

Usually, administration charges seem like in sync with the wishes of householders. When a lodge outperforms the market, administration charges usually rise as a result of the working thresholds required to set off incentive charge funds are met. Homeowners and asset managers are frequently analyzing new operational measures to encourage administration to enhance efficiency.

Some components are out of the management of administration. Subsequently, to the diploma that such components affect a lodge’s efficiency, a administration firm can see its revenue fluctuate. This might imply a loss in charges like we noticed in 2009 and 2020; nonetheless, it might additionally imply administration corporations will “experience the improved tide” as market circumstances enhance. Administration charges tied to performance-based administration are right here to remain, and house owners and asset managers will possible proceed to seek out inventive methods to carry managers accountable. These efforts will hopefully guarantee continued enchancment within the business, barring any black swan occasions or financial downturns.