Though we’re nicely into the brand new yr, the worldwide lodge trade remains to be going through most of the similar struggles from years previous, together with staffing shortages. These shortages are pushing lodges to extend pay and advantages to compete for out there labor.

When taking a look at america, common hourly earnings for workers within the leisure and hospitality sector are the best they’ve ever been—averaging $23.37 in 2023 and hitting $23.86 in January 2024, based on knowledge from the Bureau of Labor Statistics. In 2023, complete labor bills hit a whopping $56.7 billion in america, up 14.2 % from the earlier yr.

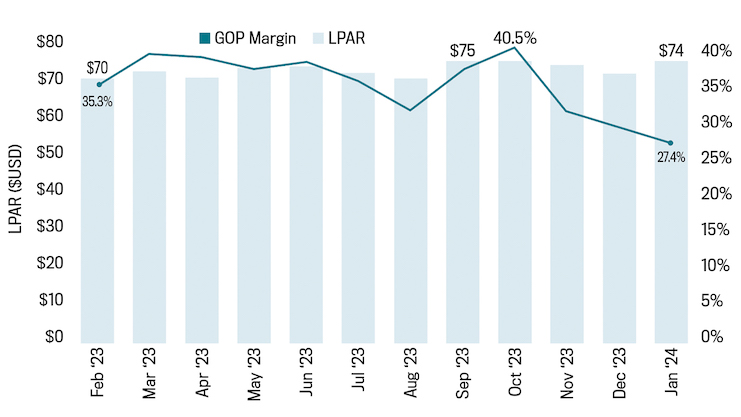

Monitoring profitability knowledge since 1990, STR exhibits labor prices at an annual development charge of two.1 %. Averages have elevated by double digits over the past three many years, and that sample is more likely to proceed via the 2020s. Labor prices on a per-available-room foundation (LPAR) peaked in 2023 at $72 and mirror the elevated pay the trade has needed to dish out to attempt to mitigate staffing shortages.

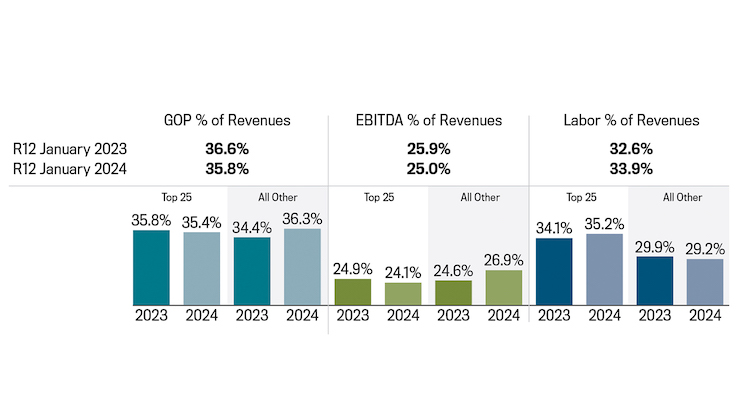

Elevated operational bills, significantly labor, have been pinching GOP margins an increasing number of. Labor prices account for over half of the entire operational bills (56 % as of January 2024), which is why they weigh so closely on earnings. GOP margins have averaged 30.4 % over the past 4 years, decrease compared to earlier many years: Nineties (41.8 %), 2000s (35.3 %), and 2010s (35.5 %).

Narrowing in on the U.S. labor developments of the final 12 months, LPAR has averaged $72, whereas GOP margins have averaged 35.4 %. The month-to-month common development charge (MAGR) for LPAR is 0.6 %, which doesn’t appear to be a lot, however that’s 0.7 share factors increased than the identical interval in 2019.

The influence of labor prices is much more profound for the Prime 25 Markets, with LPAR at $83 over the past 12 months (+13 % YoY) vs. solely $56 for all different markets. Regardless of the LPAR improve, GOP margins had been up 1.8 share factors due to robust development (10 %) in complete income per out there room development (TRevPAR).

Whereas all main markets have realized development in LPAR, those who have posted the most important LPAR will increase (averaging 19.2 %) are Nashville, Seattle, Washington, D.C., St. Louis, and Houston.

Whereas one might imagine the markets with the best LPAR % change have the bottom ranges of gross working revenue per out there room (GOPPAR), it’s really the markets which have been unable to make positive aspects in complete income per out there room (TRevPAR). Miami,

New Orleans, San Diego, Anaheim, San Francisco, and Los Angeles realized LPAR development between 7.7 % and 14.7 %, which is taken into account reasonable to low. Progress in that metric, coupled with a TRevPAR share change of –1 % to +5 %, led to flat or detrimental GOPPAR modifications throughout the aforementioned markets. Though labor is rising throughout all high markets, it’s these markets which might be unable to drive any actual development in complete revenues which might be realizing a larger influence on the underside line.

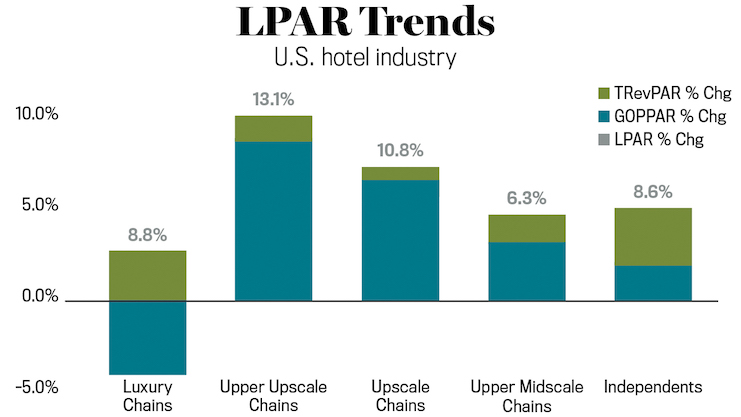

When taking a look at service varieties, full-service lodges are realizing a a lot bigger improve in LPAR versus restricted service, +12.2 % vs. +6.9 %, respectively. Nevertheless, each service varieties are realizing robust development in TRevPAR: full service at +4.8 % and restricted service at +5.1 %, which has allowed for enhancements in GOPPAR. Higher upscale and upscale chains proceed to understand sufficient TRevPAR development to fight the rise in LPAR, which has allowed for revenue development. The expansion in KPIs for these chain scales factors to continued restoration of teams. The one chain scale experiencing revenue declines is luxurious, the place a 2.7 % TRevPAR improve was not almost sufficient to combat off the 8.8 % development in LPAR.

As hoteliers navigate the ever-rising development in labor prices, it turns into more and more evident that sustaining profitability hinges on each controlling the expansion via new artistic operational changes and expertise (e.g., versatile schedules, much less room

cleansing, F&B robots) and rising top-line revenues.