Sturdy loyalty applications assist resort manufacturers decrease buyer acquisition prices, enhance direct-to-consumer entry, and offset occupancy shortfalls throughout shoulder intervals and weaker financial circumstances. After analyzing publicly accessible information from 5 giant resort firms, we discovered that whereas progress in a number of key metrics slowed in 2023, loyalty members’ total contribution to occupancy elevated, although marginal contribution per member contracted.

Advantages

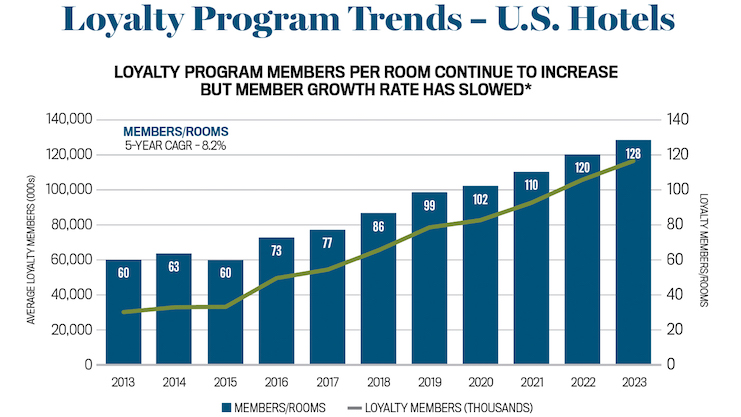

The typical variety of loyalty program members on the topic 5 firms elevated 11.3 p.c in 2023, slower than the 15 p.c progress charge in 2022. Members-per-room elevated 6.4 p.c 12 months over 12 months from 120 to 128.

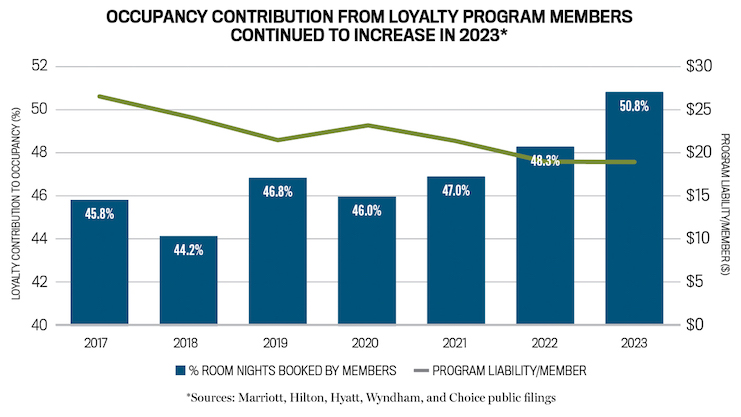

The typical contribution to occupancy from loyalty members grew to just about 51 p.c in 2023, up from roughly 48 p.c in 2022. Nonetheless, loyalty applications have gotten much less dominated by frequent vacationers (+30 nights a 12 months). The variety of room nights booked by the common loyalty member in 2023, 1.1, returned to 2019 ranges final 12 months. That is properly under the 1.8 nights stayed per member in 2016, suggesting that the proportion of membership comprised of heavy customers is declining because the applications have change into extra tied to bank cards and affiliate applications and fewer straight with simply frequent journey. This doesn’t imply that members are much less beneficial, as they may have completely different journey patterns and fill seasonal dips or weak demand intervals, however this pattern does point out that the bottom of loyalty members contributed fewer nights than they did in 2016.

Legal responsibility

From the model perspective, loyalty program legal responsibility per member, which is the common greenback worth every member has accrued in unredeemed factors, ended 2023 at 87 p.c of the pre-pandemic ranges. Loyalty level redemption revenues elevated by 11 p.c final 12 months to $1.1 billion from $982 million in 2022. This might point out that extra factors had been redeemed to e-book rooms in 2023; nevertheless, it is also as a result of 4 p.c rise in ADR or the devaluation of loyalty factors wanted to earn a free night time.

Prices

The company prices incurred to take care of loyalty applications are paid for by charges charged to the accommodations within the system. Per the eleventh version of the Uniform System of Accounts for the Lodging Trade (USALI), visitor loyalty program charges embrace “any prices related to applications designed to construct visitor loyalty to the property or model.” To achieve a greater understanding of current tendencies in visitor loyalty program charges, CBRE analyzed the loyalty program charge funds made by 4,454 U.S. accommodations in our Developments within the Lodge Trade database from 2022 to 2023. In 2023, these accommodations averaged 215 rooms and achieved a 69.3 p.c occupancy with a $211.44 ADR.

In 2023, visitor loyalty program charges averaged 1.5 p.c of complete working income, a ratio that was best at upper-midscale (2 p.c), upscale (1.6 p.c), and upper-upscale accommodations (1.6 p.c). Loyalty charges as a p.c of complete working income was lowest at economic system (.3 p.c) and midscale (.9 p.c) properties. To a point, this metric serves as a proxy for the chain scales that profit most from visitor loyalty members staying (for pay) at accommodations and incomes factors. Generally, loyalty program members journey most steadily for conventions and enterprise, explaining the bias towards the upper priced chain scales. Since loyalty program charges are charged as a p.c of income earned, it isn’t shocking that charges on a dollar-per-occupied-room (POR) foundation are best at luxurious and upper-upscale accommodations, and lowest at midscale and economic system accommodations.

Visitor loyalty program charges are sometimes charged as a p.c of the full income earned when loyalty program members pay to remain at a resort and earn factors. Subsequently, with loyalty program charges rising at a better tempo than complete working income, it may be assumed that loyalty program members symbolize an rising share of paying company 12 months over 12 months.

From 2022 to 2023, complete working income on the CBRE pattern elevated by 8.8 p.c, whereas visitor loyalty program charges paid grew by 17 p.c. The best distinction between income and loyalty program charge progress was noticed within the upscale, economic system, and upper-midscale segments.

For our Developments survey, CBRE captures 4 completely different franchise-related charges on a discrete foundation: royalty charges, advertising assessments, reservation charges, and visitor loyalty program charges. From 2022 to 2023, the 17 p.c enhance in loyalty charges was best among the many 4 elements, whereas every of the three different elements elevated by lower than 10 p.c in 2023. The magnitude of the distinction in year-over-year change confirms that loyalty program members are comprising a rising share of paid company. It may be assumed that the resort firms will enhance the prices of all 4 franchise-related charges, so extraordinary progress in visitor loyalty charges paid should be attributable to a rise within the variety of loyalty visitor stays.

Value Transparency

In addition to the visitor loyalty program charges, resort house owners are additionally accountable to pay for the additional facilities and companies offered to loyalty program members throughout their stays. Such prices might embrace complimentary meals and beverage, upgraded rooms and housekeeping companies, factors offered as compensation for service failures, and entry to an unique government lounge.

To offer resort house owners and operators with better insights into these prices, the twelfth version of USALI consists of new loyalty program expense classes throughout the rooms, administrative and normal, and gross sales and advertising departments. CBRE will start to benchmark these extra prices in 2026 as the brand new USALI is adopted by the business.