What’s lodge insurance coverage?

Lodge insurance coverage is a particular kind of insurance coverage designed to present hospitality companies financial safety towards numerous dangers and liabilities. It’s primarily a security internet that enables hoteliers to guard their property from unexpected circumstances comparable to injury or theft. Having insurance coverage can go a good distance to assist be certain that your lodge can get pleasure from long-term success.

Provided that inns could be distinctive lodging and bodily buildings, insurance coverage insurance policies will typically additionally take note of all of the totally different facilities and areas throughout the property too. This may embrace the bar, fitness center, pool, and convention rooms.

How a lot does lodge insurance coverage price?

The price of lodge insurance coverage has no definitive quantity, since there are such a lot of variables primarily based on the distinctive circumstances of your lodge and the varieties of insurance coverage you’ll want or select.

The price of your insurance coverage will largely depend upon:

- Dimension of your lodge: Bigger inns usually require increased protection and due to this fact increased premiums.

- Location: Is your property in a high-risk space (e.g. pure disasters or crime)? If that’s the case, the insurance coverage prices will probably be increased.

- Lodge kind: A funds lodge may have a unique profile to a luxurious lodge for instance, and may have totally different insurance coverage price outcomes.

- Protection limits: The quantity of protection you select will impression the premium. Greater protection limits sometimes end in increased premiums.

- Deductible: A better deductible can decrease your premium however means you’ll pay extra out of pocket for claims.

- Supplier: Not all insurers have the identical buildings or assessments, so that you’ll want to do a little analysis.

As a normal information, a really small B&B may solely have insurance coverage premiums of lower than $5,000/12 months, whereas a bigger luxurious property is perhaps paying $20,000+.

For instance, lodge insurance coverage within the UK could be as little as £1,050 every year for small inns and B&Bs.

The place to get a lodge insurance coverage quote?

Typically, there are 3 ways to supply an insurance coverage quote in your lodge:

- Use a dealer to discover a supplier and negotiate a coverage for you.

- Deal instantly with a neighborhood insurance coverage firm in your nation or area.

- Use on-line marketplaces to analysis and examine your choices.

The extra data you possibly can present and the extra questions you possibly can reply about your enterprise, the extra correct and useful your quote can be.

On this weblog, we’ll present a complete information to lodge insurance coverage, together with what it could actually cowl in your property, the way it works, and what it may cost your lodge enterprise.

Why are lodge insurance coverage packages necessary?

With a lot exercise taking place and many alternative facilities and companies operating, inns could be uncovered to fairly a big diploma of economic threat. The potential threat of damage, injury, or theft is excessive – and that’s earlier than even taking into consideration components comparable to climate occasions.

From visitor disputes, to workers compensation, to property injury and even collisions involving your shuttle transport, your lodge is all the time going through some type of monetary problem. Nonetheless, many companies usually are not all the time ready. As an example, a examine revealed that as much as 57% of Australian small and medium companies is perhaps underinsured.

Lodge insurance coverage packages guarantee that you’re protected and could be coated for any hardship you encounter, permitting you to take care of efficient income administration. With a lodge insurance coverage coverage, you possibly can acquire extra confidence that your enterprise can survive long-term. It additionally helps your property proceed operating easily when one thing does happen, since you don’t must spend time stressing or on the lookout for different options.

With such a wide range of dangers – this implies it’s additionally necessary to contemplate a wide range of lodge insurance coverage varieties, or a complete insurance coverage technique, to verify nothing slips by means of the cracks. For instance, employee’s compensation will come beneath a totally totally different kind of insurance coverage to fireplace injury to the property.

Cut back prices and increase income with the proper tech

Take the stress off your lodge insurance coverage prices by utilizing SiteMinder’s platform to spice up bookings and income, fulfill friends, and preserve knowledge safety.

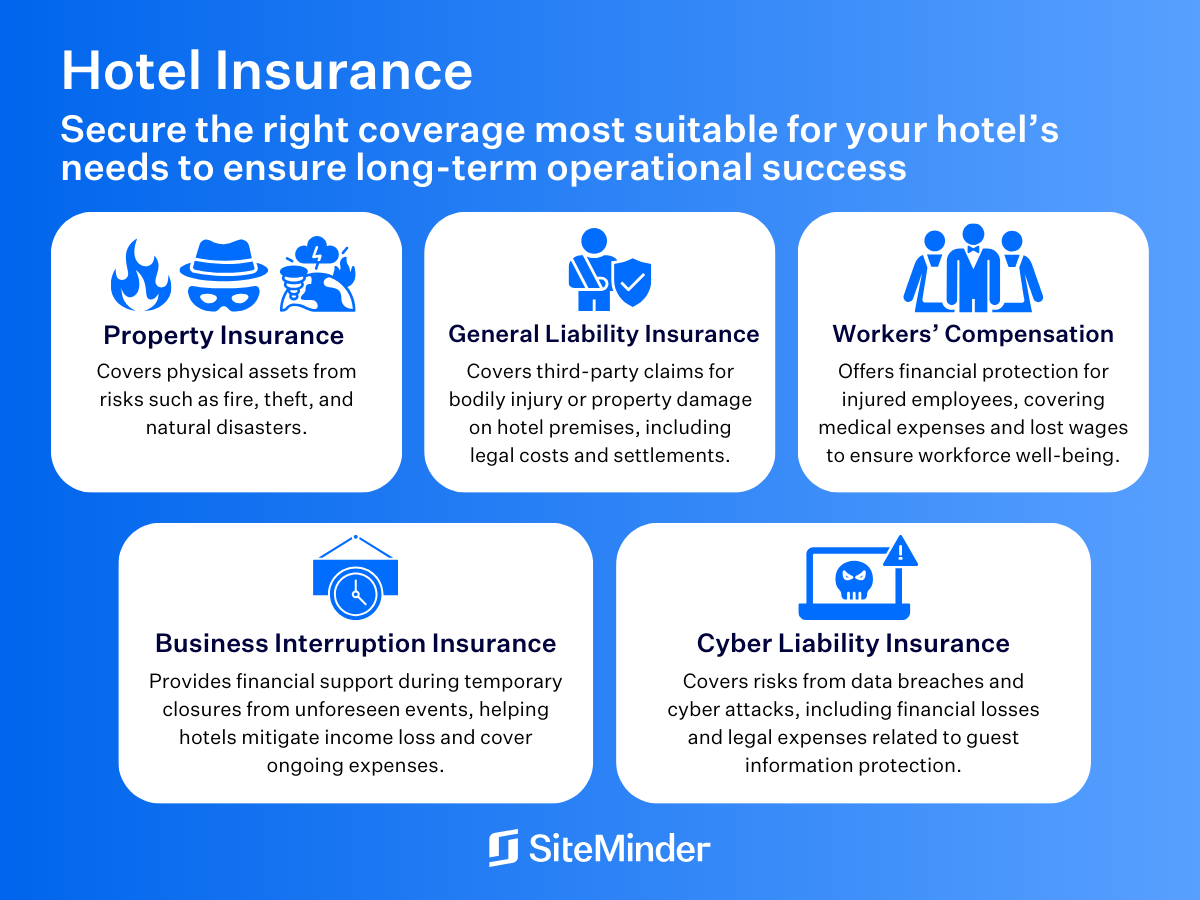

What’s included in lodge insurance coverage protection?

To get a full image of what is perhaps included in lodge insurance coverage protection, we’ve got to contemplate all the varied varieties of lodge insurance coverage. Let’s check out 8 classes:

1. Property injury

Maybe the most typical, this insurance coverage kind will cowl injury to your bodily property or the gear and furnishings inside. Nonetheless, it might additionally apply to property belonging to the visitor as nicely.

2. Lack of revenue

Somewhat than simply insurance coverage to restore injury, you may additionally want insurance coverage to cowl the cash you’ll lose if it’s important to shut your lodge for a time frame.

3. Equipment breakdown

This refers to failure of home equipment comparable to fridges which consequence within the spoiling of meals and drinks, resulting in elevated prices and lack of income.

4. Public and product legal responsibility

One other widespread insurance coverage kind which operates to guard towards negligent actions by your or your workers, or as results of damage/sickness from a product equipped by you. It is going to additionally embrace dangers comparable to liquor – journeys and falls because of intoxication – and meals and beverage (burns from sizzling meals or liquids).

Are inns accountable for stolen property? If a visitor has property stolen, your lodge could or might not be liable. It depends upon the circumstances of the theft and likewise the native legal guidelines and rules.

5. Cyber safety

Information safety is turning into an increasing number of necessary, and within the case of inns there’s quite a lot of potential hurt. Within the case of massive chains, giant quantities of non-public buyer data presents a precious goal for hackers and scammers.

6. Coastal property insurance coverage

For those who’re within the area of interest scenario of proudly owning or working a waterfront lodging, you possibly can insure towards occasions comparable to hurricanes, windstorms, erosion, and extra.

7. Auto insurance coverage

One other area of interest instance is that if your lodge operates a fleet of autos for visitor transportation or different functions. You may wish to shield towards loss or injury of those autos, and in some circumstances chances are you’ll be required to have insurance coverage to even drive them within the first place.

8. Lodge umbrella insurance coverage

Lodge umbrella insurance coverage, or business umbrella insurance coverage, refers to claims which might be exterior your different liabilities which can make it easier to keep away from out-of-pocket bills.

Key lodge insurance coverage necessities: Employee’s compensation

The workers at your lodge are simply as necessary as your friends – they’re typically going through the identical dangers and will have related claims. So it’s very important you might be masking employee’s compensation in your insurance policy.

It’s a authorized requirement in lots of jurisdictions to guard each employers and workers in case of office accidents or diseases, and sometimes covers:

- Medical bills: This contains prices of physician visits, surgical procedures, drugs, and bodily remedy.

- Misplaced wages: If an worker is unable to work because of a work-related damage or sickness, employee’s compensation can present wage alternative advantages.

- Vocational rehabilitation: If an worker is unable to return to their earlier job, employee’s compensation could cowl the price of job retraining or vocational rehabilitation.

- Loss of life advantages: Within the tragic occasion of a work-related fatality, employee’s compensation could present loss of life advantages to the worker’s household.

Employee’s compensation insurance coverage supplies a security internet for each the employer and the worker.

To your lodge, this contains:

- Authorized Compliance: Failing to have employee’s compensation insurance coverage can lead to vital fines and penalties.

- Threat Administration: It helps shield the enterprise from lawsuits and monetary losses.

- Worker Morale: Offering employee’s compensation advantages can enhance worker morale and loyalty.

And it offers your workers peace of thoughts and monetary safety, doubtlessly rising their satisfaction and loyalty.

The right way to discover the most effective lodge insurance coverage coverage

Discovering the most effective lodge insurance coverage coverage includes cautious consideration and comparability.

Listed here are among the most necessary steps.

- Perceive your particular wants: How a lot insurance coverage will you really need? Consider how huge your property is, what number of workers you’ve gotten, what facilities you’ve gotten, and the place your property is positioned. For instance, if you happen to personal and function a B&B your self, you in all probability received’t want cowl for employee’s compensation.

- Procure a number of quotes: To get essentially the most applicable protection and the most effective deal, it’s best to contact no less than a couple of suppliers to see what they will supply. Bear in mind to learn the wonderful print.

- Do your due diligence: A supplier could appear stable on the floor however you’ll want to select an insurance coverage accomplice that’s dependable and financially steady. It’s a good suggestion to have a look at opinions and the historical past of the enterprise.

- Frequently evaluate your phrases: Re-evaluate your wants as your enterprise grows and adjustments, since your insurance coverage wants could change as nicely.

Do you have to use lodge insurance coverage brokers?

It could actually undoubtedly be useful to seek the advice of with a lodge insurance coverage dealer. Insurance coverage brokers concentrate on understanding the distinctive wants of the hospitality business. They’ll tailor a coverage to your particular wants and threat profile and likewise negotiate with insurers to get the most effective charges and protection.

Frequent lodge insurance coverage corporations

For those who’re on the lookout for a couple of examples of who may be capable of insure your enterprise, listed below are some widespread corporations from all over the world.

Lodge insurance coverage in Australia

- Allianz Australia: A significant insurer providing a variety of enterprise insurance coverage merchandise, together with these tailor-made to the hospitality business.

- QBE Insurance coverage: Offers complete insurance coverage options for companies, together with inns and motels.

- AIG Australia: Presents a variety of insurance coverage merchandise, together with property, legal responsibility, and cyber insurance coverage for inns.

- Marsh: A worldwide insurance coverage dealer that may make it easier to discover the proper insurance coverage protection in your lodge enterprise.

Lodge insurance coverage in the US

- Chubb: A number one world insurer providing a wide range of insurance coverage merchandise for inns, together with property, legal responsibility, and cyber insurance coverage.

- Travellers: Offers complete insurance coverage options for the hospitality business, together with property, casualty, and employees’ compensation insurance coverage.

- Hartford: Presents a variety of insurance coverage merchandise for inns, together with property, legal responsibility, and enterprise interruption insurance coverage.

- Cincinnati Monetary: Offers insurance coverage options for inns, together with property, legal responsibility, and employees’ compensation insurance coverage.

Lodge insurance coverage in the UK

- Aviva: A significant insurer within the UK providing a variety of insurance coverage merchandise for inns, together with property, legal responsibility, and enterprise interruption insurance coverage.

- AXA: A worldwide insurer providing a wide range of insurance coverage merchandise for inns, together with property, legal responsibility, and cyber insurance coverage.

- Hiscox: Offers specialised insurance coverage options for companies, together with inns and hospitality venues.

- Zurich: Presents a variety of insurance coverage merchandise for inns, together with property, legal responsibility, and enterprise interruption insurance coverage.

Boutique lodge insurance coverage

We talked about that some properties may have totally different insurance coverage wants and circumstances than others. Boutique inns are a novel property kind which may typically function costly artworks, vintage furnishings, and specialised facilities or gear. Because of this, your property may have extra insurance coverage protection to adequately shield your revenue.

Luxurious lodge insurance coverage

Equally, luxurious inns home very precious objects, merchandise, and companies together with various totally different workers positions, in-room facilities, and property-based experiences. It could be the case that you just’ll want increased legal responsibility or property safety limits.

With lodge insurance coverage offering peace of thoughts, you may also scale back the stress of operating your property by utilizing cutting-edge expertise…