In a brand new submitting with the SEC, the Walt Disney Firm has provided a breakdown on the allocation of its deliberate $60 billion funding in Parks & Resorts as a part of a 10-year funding plan. This publish shares the most recent particulars, as the way forward for Walt Disney World and Disneyland begin to come into focus.

For starters, this SEC submitting is titled “Disney’s Plan for Shareholder Worth Creation” and is a part of the continuing proxy struggle with Nelson Peltz’s Trian and that different activist investor that wishes to do AI stuff and for theme parks to be handled like common ole industrial actual property. It’s turn out to be obvious that the majority of you have got misplaced curiosity within the battle of the board–or have already made up your thoughts–so we’re not going to fixate on any of that.

Simply remember that that is a part of a full 60 web page SEC submitting that additionally hypes up the present board and knocks the proposed various slates. It additionally makes the case for Iger’s imaginative and prescient for Disney, discussing studio creativity, streaming profitability, and the way forward for ESPN. You realize, the standard suspects for Disney as the corporate continues rebuilding.

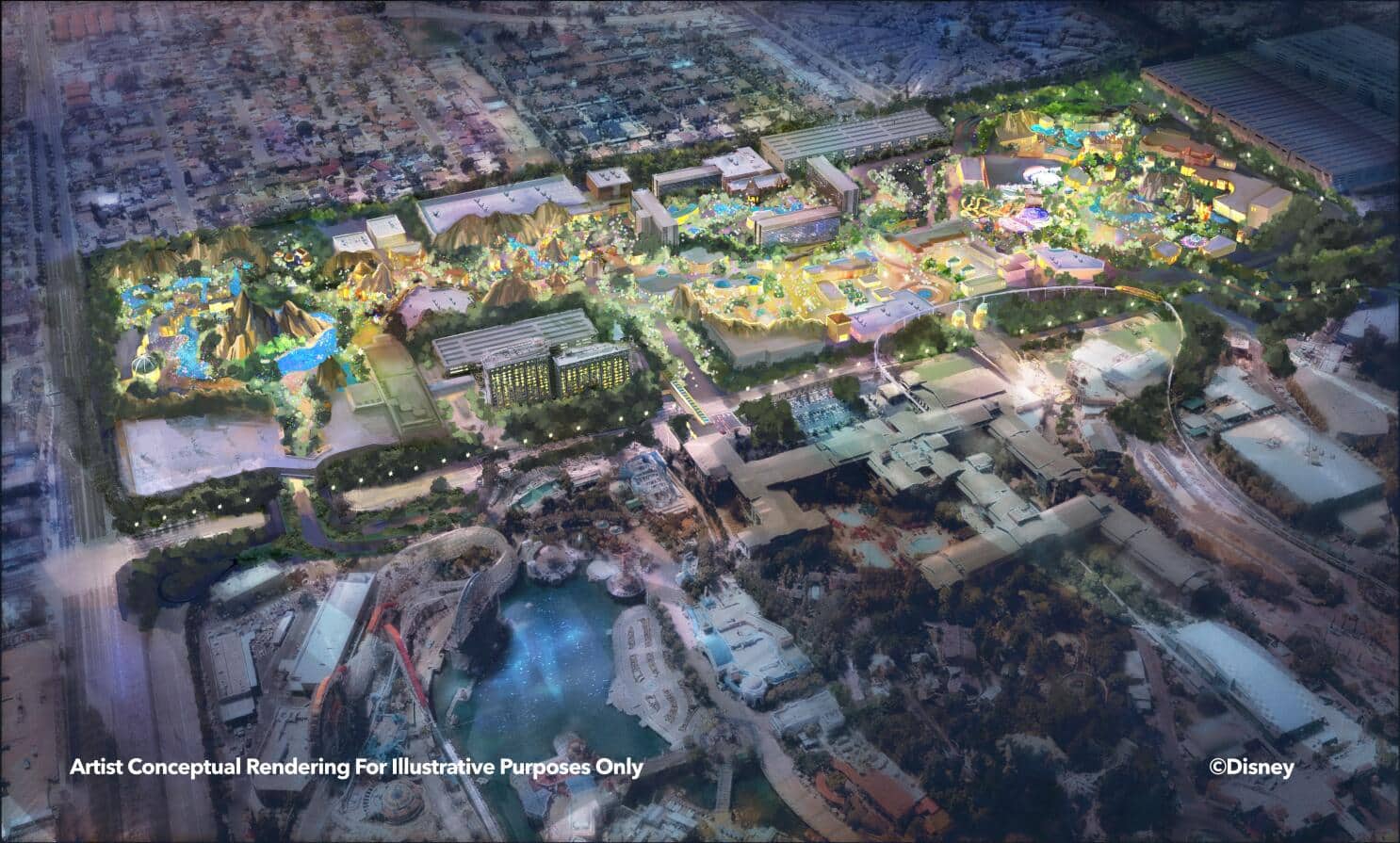

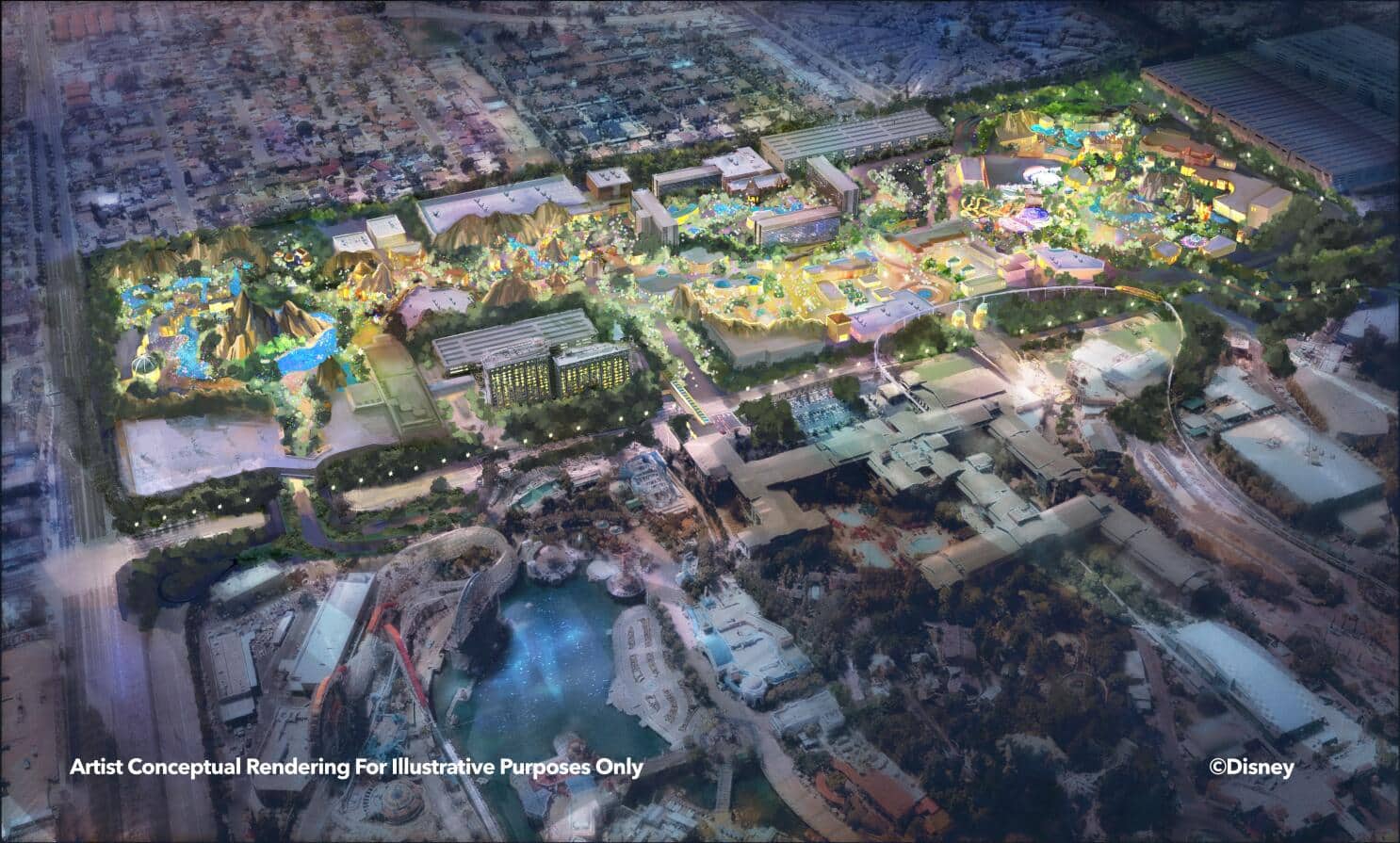

Within the presentation, Disney reiterates its $60 billion funding plan for the subsequent 10 years, which incorporates capital to broaden capability at Walt Disney World, Disneyland, Disney Cruise Line and the worldwide parks.

In line with that, investments will construct upon Disney Parks & Resort’s observe document of producing outsized ROI (within the presentation, the corporate notes that Parks & Resorts is the corporate’s most worthwhile phase) and can deal with:

- Accelerating storytelling by using its wealth of mental property, untapped tales and unmatched creativity

- Increasing footprints: Disney has over 1,000 acres of accessible improvement parcels throughout the six present resorts in North America, Europe, and Asia

- Investing in revolutionary expertise to enhance the visitor expertise

- Reaching new followers world wide: for each park visitor as we speak, there are over 10 shoppers with Disney affinity who don’t go to the parks in a given 12 months

Disney additional elaborates that its 10-year funding plans are to “create magical new experiences and refresh present infrastructure.” The corporate additional states that roughly 70% of the plan is earmarked for capacity-expanding investments.

Breaking this down additional, Disney signifies that fifty% of the capital allocation plan is for theme parks and resorts, 20% is for Disney Cruise Line or “different” and 30% is for expertise and upkeep.

It’s in all probability apparent, however they’re attending to the 70% ‘capacity-expanding’ quantity by including collectively theme parks with cruises/different. The remaining 30% is for expertise and upkeep. What, precisely, does all of this imply? Let’s break it down a bit.

First, you’ve in all probability heard a part of this earlier than. On the earnings name a number of weeks in the past, new CFO Hugh Johnston stated that “roughly 70% [of the $60 billion plan] is earmarked for incremental capability increasing investments across the globe.”

Bob Iger added the next: “We’re already exhausting at work at principally figuring out the place we’re going to position our new investments and what they are going to be. You may just about conclude that they’ll be throughout, that means each single considered one of our places would be the beneficiary of elevated funding and, thus, elevated capability, together with on the excessive seas, the place we’re at the moment constructing three extra ships.”

“I’m not going to essentially offer you far more of a way of timing, besides that we’re exhausting at work at getting this stuff principally conceived and constructed. And we’ve bought a menu of issues that can principally begin opening in 2025, and there’ll be a cadence yearly of further funding and elevated capability,” continued Iger.

It looks as if every time there’s an replace on this, a single new nugget of knowledge is shared. On this case, it’s the 50/20 breakdown between the theme parks and Disney Cruise Line. Properly, technically cruise ships slash different.

My guess is the “different” right here is the opposite parts of Disney Signature Experiences, which is DCL plus Adventures by Disney, Aulani, Storyliving, Golden Oak, and Disney Trip Membership. I’m not satisfied DVC investments would pull from this bucket relatively than theme parks and resorts, however I don’t know sufficient to have an knowledgeable opinion. (The others all would, however how a lot CapEx are they realistically going to wish within the subsequent decade?)

From my perspective, that is excellent news–however unsurprising. When the $60 billion plan was first introduced, one of many ways in which it was dismissed by cynical Walt Disney World followers was by saying that it’ll in all probability principally go to Disney Cruise Line. My take then, as now, was that’s tough to see taking place for 2 causes.

First, DCL is wrapping up one enlargement cycle and it’s exhausting to think about Disney being overly aggressive with additional fleet enlargement earlier than assessing demand. Second, shipyard commitments are already years out. Disney could be hard-pressed to construct a number of new ships within the subsequent decade even when they needed. If something, the 20% quantity for Disney Cruise Line appears excessive to me–so I ponder how a lot of that’s going to the “different” areas of Disney Signature Experiences.

In any case, 70% of this $60 billion going in the direction of capacity-expanding investments is nice information. For these questioning what this implies, it means that Disney goes to deal with constructing new lands and sights relatively than refurbishing present issues or spending cash on placemaking.

There are apparent examples of what this might imply. If Disneyland builds World of Frozen as a Fantasyland enlargement or Pandora in a number of the area opened up as a part of the DisneylandForward proposal, that’s capacity-expanding. When the Past Huge Thunder venture for Magic Kingdom companies up, that’ll be capacity-expanding. A brand new World Showcase pavilion could be capacity-expanding. Ditto a brand new experience changing lifeless area in Animation Courtyard.

The brand new attraction (rumored to be a curler coaster) now underneath improvement adjoining to Zootopia is capacity-expanding. Constructing a Marvel E-Ticket at Hong Kong Disneyland could be capability increasing. Identical goes for growing the enlargement pad on the far aspect of the brand new lake at Walt Disney Studios Park.

However it’s in all probability a bit extra sophisticated than that really. Altering Rock ‘n’ Curler Coaster Starring Aerosmith right into a theoretical ‘Taylor’s Model’ of the experience or one set in Wakanda in all probability will not be capacity-expanding. Nonetheless, the overhaul from Ellen’s Vitality Journey to Cosmic Rewind arguably was capacity-expanding for EPCOT, as a result of it’s primarily a wholly new experience and it changed one thing unpopular. What about Tropical Americas in Animal Kingdom? In all probability a little bit of each.

This brings us to the 30% for expertise and upkeep. It type of went with out saying that if 70% was for capacity-expanding additions, then 30% was for updates that did not broaden capability. However now it’s listed as a line merchandise–expertise and upkeep–and that’s seen as regarding by some followers.

It shouldn’t be. This doesn’t imply upkeep within the sense of the annual closure to Kali River Rapids. It’s not maintenance, common experience refurbishments, or in a single day preventative upkeep. These are not CapEx, they’re working bills. Whereas Walt Disney World very a lot must be spending far more on routine upkeep, it largely shouldn’t be coming from the $60 billion.

Technically, for these investments to qualify as CapEx, they’d want to increase the helpful lifetime of the attraction. (And I assume that is the usual getting used since that is for buyers and filed with the SEC.) The Rock ‘n’ Curler Coaster instance above? It wouldn’t qualify in the event that they’re merely altering out the prop…but it surely’s a doubtlessly completely different story fully if the experience system or infrastructure is changed.

One other instance could be Spaceship Earth. If Imagineering went in and easily added the Story Gentle stuff, that shouldn’t qualify. But when in addition they changed the observe and experience system, it could. And that’s extra doubtless than not what would occur, since Spaceship Earth has been overdue for a significant overhaul for the final 5 years. That may not broaden capability, however it could fall into that 30% bucket.

Just about each attraction that might conceivably be reimagined is at a degree in its lifecycle the place extra than simply the thematic components have to be up to date. It additionally is sensible to make infrastructure updates that enhance reliability and prolong the helpful lifetime of the asset.

All of this bears mentioning as a result of the primary half of the last decade goes to be pretty heavy on reimaginings. Zootopia within the Tree of Life, Indiana Jones Journey changing DINOSAUR, no matter’s up with Check Monitor, and different yet-to-be-announced transformations. (As I’ve stated earlier than, my cash is on Rock ‘n’ Curler Coaster being subsequent up, and probably Journey into Creativeness.)

That is nearly essentially the case if Bob Iger’s remark about an annual cadence is appropriate. We’ve all seen how “rapidly” Disney builds new lands and sights. Even when development began as we speak on a Villains Lair past Huge Thunder (it gained’t), the opening date wouldn’t be till 2027 on the absolute earliest. Against this, they might shut DINOSAUR in the direction of the tip of this 12 months or early 2025 and have Indiana Jones Journey prepared by 2026. Regardless of the plan is for Rock ‘n’ Curler Coaster may very well be achieved even sooner.

None of this needs to be an enormous shock. Iger beforehand indicated that the $60 billion in spending on Parks & Resorts over the subsequent 10 years could be backloaded. Josh D’Amaro has made feedback that they need to develop the footprints of the parks whereas additionally enhancing utilization inside them.

We’re completely going to get reimaginings–and most of these will come from this $60 billion bucket. Simply need to mood expectations a bit, whereas additionally protecting how that 30% on tech and upkeep may very well be a great use of funds, particularly at Walt Disney World which is in want of experience updates.

Personally, I nonetheless suppose this can be a pretty optimistic improvement. That fifty% of $60 billion being earmarked for capacity-expanding additions within the theme parks continues to be $30 billion. That’s so much. Granted, there are different theme parks on the earth, however no matter is inbuilt Hong Kong and Shanghai solely requires a partial funding from Disney. (Not one of the cash spent on Tokyo Disney Resort comes from Disney–that’s all revenue.)

We all know that the corporate plans to spend about $2 to $3 billion on Disneyland. Even earlier than the $60 billion quantity was launched, Disney stated that $17 billion is earmarked for Walt Disney World. They haven’t talked about that quantity shortly, however this could affirm that it’s in all probability fairly near correct–if not an understatement of the funding.

Disney is simply spending $12 billion on cruise ships (and different) plus $3 billion on Disneyland. I’d guess that one other $4 billion mixed is destined for the Asia parks, which could appear low, however they’re wrapping up developments and no matter is spent solely partially comes from Disney’s coffers. Disneyland Paris is the most important wildcard, as investments there are actually beginning to repay–so possibly one other $5 billion there? (Wouldn’t shock me in the event that they guess even larger on DLP.)

Regardless of the way you slice it, it appears to me like Walt Disney World will see at the least $17 billion in funding. (Perhaps the $17 billion is only for capacity-expanding additions, and so they’re additionally getting one other few billion for upkeep and tech?) After accounting for inflation considerably growing prices, that’s about on par with the last decade that introduced us Pandora, Toy Story Land, Star Wars: Galaxy’s Edge, Cosmic Rewind, and TRON Lightcycle Run.

Additionally in that very same decade, untold sums had been spent on highway and different infrastructure work in addition to (figuratively and actually) dumped right into a pit at EPCOT. It wouldn’t shock me within the least if the quantity spent on issues that didn’t broaden capability at Walt Disney World during the last decade was above 40%. If there’s a greater roadmap for the subsequent decade and cash is spent extra rigorously, it may go even additional. (Right here’s hoping for no new international pandemics that throw monkey wrenches into plans halfway by means of!)

With all of that stated, I don’t need to be accused of portray an excessively optimistic image. My greatest concern when seeing that 30% quantity for tech and upkeep is a repeat of the MyMagic+ and NextGen boondoggle, the place billions of {dollars} are blown on interactive junk and makes an attempt at avoiding constructing new sights. (One of many good issues about Iger nonetheless being round is he is aware of that was a mistake and hopefully realized from it!)

Expertise is vital and Disney does have a patchwork of legacy IT techniques. These would require funding over the subsequent decade, and possibly pretty vital sums. That cash clearly needs to be spent–simply as Disney ought to enhance infrastructure consisting of roadways, sidewalks, and so forth. It’s unsexy, but it surely’s vital. I simply hope they spend it rigorously and we don’t get one other Genie itinerary builder that retains sending me to the carrousel for my first experience of the day. An entire and utter waste of time, expertise and cash.

One other concern is the backloaded nature of the capacity-expanding additions. One truism with Disney is that section 2 by no means occurs, as a result of budgets get lower or actual world occasions intervene. All it takes is a recession and Wall Road may get spooked and search for Disney to undertake shortsighted austerity measures. And Disney would, as a result of they’re beholden to investor whims, sadly.

The excellent news is that, within the right here and now, Wall Road desires theme park investments. Disney Parks is the one massive vivid spot for the corporate. The division has been resilient, at the same time as actually every little thing else has faltered. The problem isn’t a need to truly spend cash on theme parks. Disney has that in spades. The issue has been the cash a part of the equation. They didn’t have the free money circulate. They do now, or relatively, will by the tip of this fiscal 12 months. It’ll occur. Lastly.

I do know that is in all probability going to be an unpopular opinion amongst jaded followers who’re skeptical of Disney’s present management and route. I additionally know I’m extra bullish than the common fan who has been burned earlier than and is now (understandably) in wait and see mode. However from my perspective, Iger and D’Amaro each saying the identical issues about enlargement and future developments for over a 12 months now reinforces that there are substantive plans, and it’s not simply posturing or hole hype. The cash has been the difficulty, not the urge for food for enlargement.

The stage is ready for a fully colossal 2024 D23 Expo. One with greater than only a bunch of “what ifs?” or daydreaming–and as an alternative precise concrete bulletins and timelines for each Walt Disney World and Disneyland enlargement (together with reimaginings). After all, that assumes all goes effectively with the proxy fights and Iger’s turnaround continues at its present trajectory. Time will inform, I suppose.

Planning a Walt Disney World journey? Study motels on our Walt Disney World Accommodations Evaluations web page. For the place to eat, learn our Walt Disney World Restaurant Evaluations. To save cash on tickets or decide which sort to purchase, learn our Suggestions for Saving Cash on Walt Disney World Tickets publish. Our What to Pack for Disney Journeys publish takes a novel have a look at intelligent objects to take. For what to do and when to do it, our Walt Disney World Experience Guides will assist. For complete recommendation, the very best place to start out is our Walt Disney World Journey Planning Information for every little thing you could know!

YOUR THOUGHTS

What do you consider the Walt Disney Firm’s plans for the Parks & Resorts? Excited that 70% of the “turbocharged” funding of $60 billion is for capacity-expansions? What about seeing $30 billion earmarked for theme parks? Suppose 30% for tech and upkeep is an excessive amount of or about proper? Do you agree or disagree with our evaluation? Any questions we can assist you reply? Listening to your suggestions–even if you disagree with us–is each attention-grabbing to us and useful to different readers, so please share your ideas under within the feedback!