Posted 5/24/24 | Might twenty fourth, 2024

I by no means depart dwelling with out journey insurance coverage. After over 15 years on the street, I’ve discovered firsthand how vital it’s. Not solely has it helped me take care of misplaced baggage, canceled flights, and medical emergencies, however it’s helped numerous associates and readers of my weblog too.

Nevertheless, journey insurance coverage is a boring subject to examine. No person likes evaluating plans and studying insurance policies. Myself included. It’s the least thrilling a part of journey planning.

Luckily, it’s by no means been simpler to discover a plan and coverage that fits your wants and funds. An increasing number of firms are making it quick and easy to get a quote, join a plan, learn the high quality print, and make a declare.

A type of firms is Freely.

What’s Freely?

Freely is a journey insurance coverage firm and security app. Like many insurance coverage firms, it supplies protection so that you may be made complete ought to one thing occur (for a lined motive) when you’re on the street. Its base plan contains all of the necessities I search for in an insurance coverage coverage, together with emergency medical care, emergency evacuation protection, journey interruption, misplaced baggage, and 24/7 assist.

However Freely does a number of issues in another way too.

Freely retains its base coverage inexpensive by not together with extra protection that you simply won’t want. However you may improve, for instance, to get additional protection on your gear in case you’re bringing worthwhile electronics or sporting gear with you. This can be a huge plus since most vacationers carry a telephone or laptop computer with them (typically each).

With most different plans, your gear is barely lined as much as $500 USD per merchandise. Freely enables you to add on to your plan to cowl your gear as much as $1,500 USD per merchandise.

However what’s actually helpful (and distinctive) is Freely’s Every day Enhance complement.

Every day Boosts are insurance coverage add-ons for stuff you received’t want daily, akin to protection to go snowboarding, lease a automotive, or go skydiving. Paying for these add-ons solely while you want them (on a day-by-day foundation) ensures that your coverage as an entire stays cheaper — however you get the protection you want while you want it.

For instance, snow or journey actions price simply $1 USD per day, whereas rental automotive protection is $15 USD per day (pricing varies by state). Should you solely are going snowboarding for a number of days of your journey or received’t be renting a automobile on your complete trip, the each day enhance ensures you aren’t paying for what you don’t want.

What Does Freely Cowl?

Freely insurance policies have a fairly wide selection of protection. At the moment, plans embody protection for the next:

Emergency Medical Bills

That is an important element of any insurance coverage plan. It’s what is going to come into play in the event you fall down some stairs and break a leg or are hospitalized since you get hit by a automotive, get sick, and so forth. In brief, in the event you’re despatched to a hospital or physician, that is what provides you emergency medical protection.

I all the time suggest vacationers have not less than $100,000 USD in protection as a result of hospital payments add up quick. Freely provides $500,000 USD in protection on the bottom plan. That’s a excessive restrict and might cowl you for the whole lot the street throws your method.

Emergency Evacuation and Repatriation

Medical and emergency evacuations may be extremely costly. These is likely to be required in the event you get injured whereas climbing and should be airlifted to the hospital, or if it’s a must to be repatriated to your house nation.

Incidents like these can price upwards of $250,000 USD, which is sufficient to bankrupt most vacationers. Luckily, Freely’s base coverage covers as much as $1,000,000 USD for emergency evacuations. That’s greater than a number of different insurance coverage firms supply do you have to want an emergency evacuation.

Emergency Dental Expense

I all the time respect journey insurance coverage insurance policies that cowl emergency dental care. Freely provides $1,000 USD for emergency protection on its base plan. This doesn’t imply you may go get a dental check-up if in case you have a cavity or desire a cleansing, however moderately that you simply’ll be capable of see a dentist do you have to expertise an unexpected emergency or sudden ache whereas in your journey.

Unintended Dying and Dismemberment

No person needs to consider the worst-case situation of dying on the street (I certain don’t) however understanding that your insurance coverage coverage can cowl these eventualities provides a number of peace of thoughts. For instance, the coverage pays $50,000 USD for unintentional dying, which (to not get too morbid) will possible be useful to your family members ought to the worst happen.

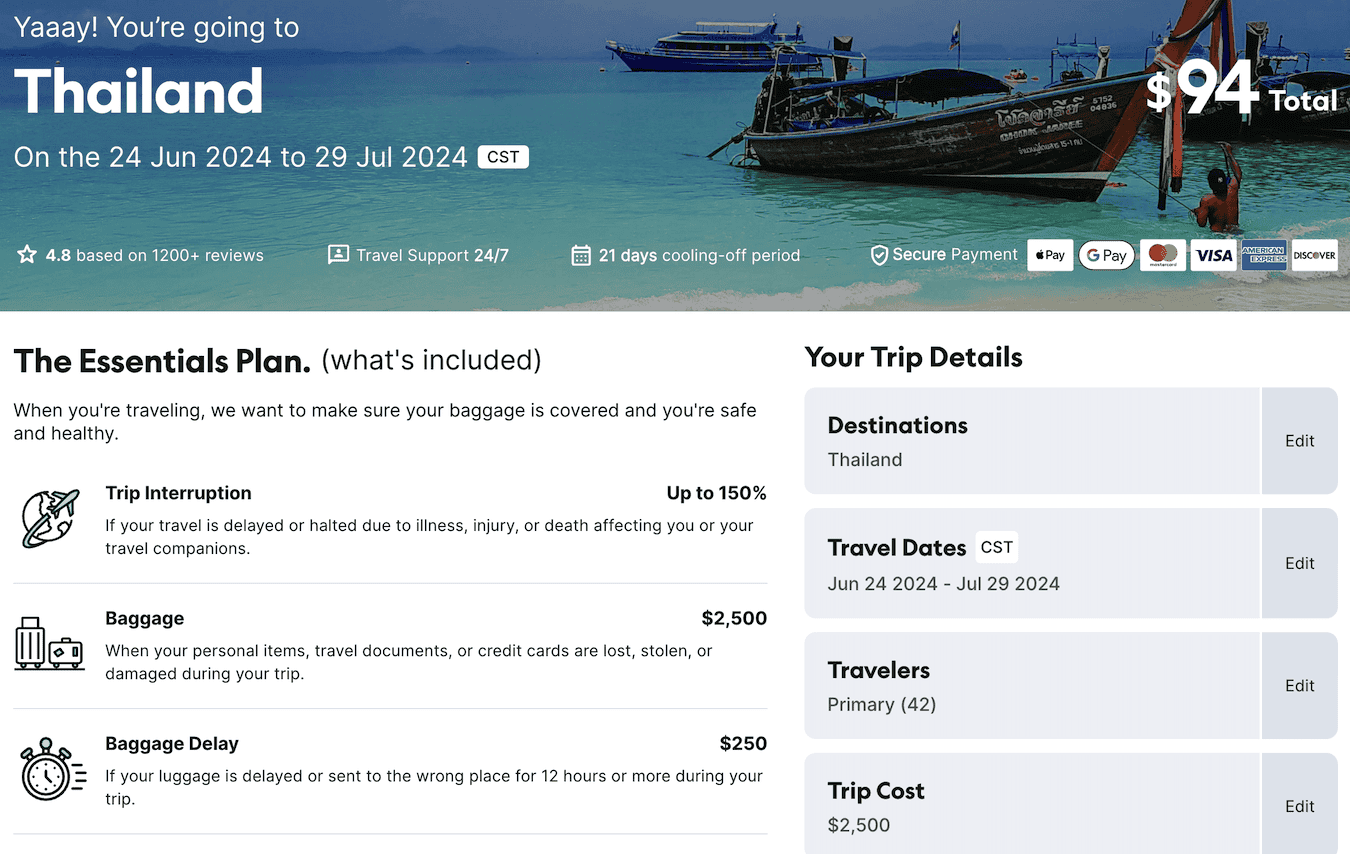

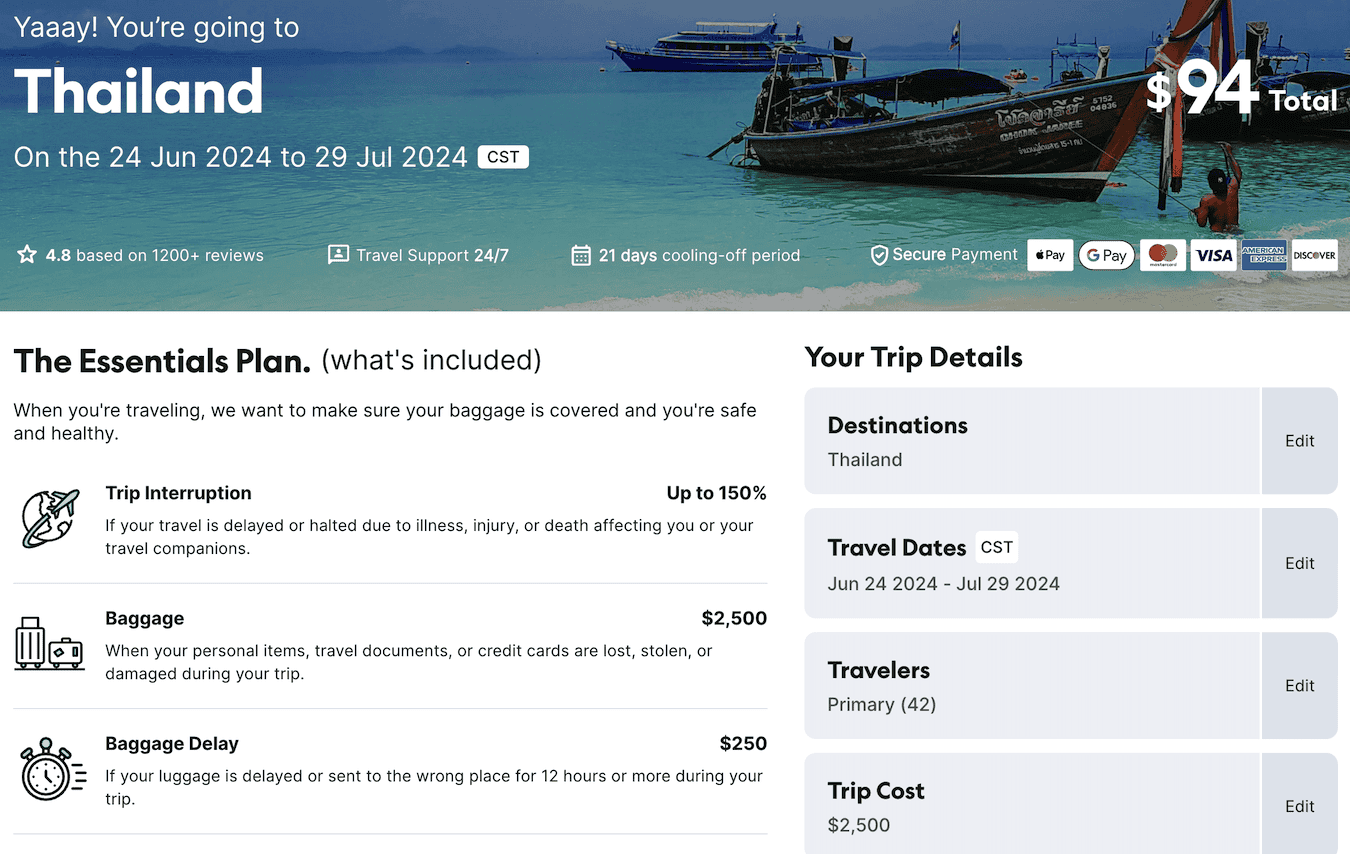

Journey Interruption

Once you miss a part of your journey or should return dwelling early on account of eligible unexpected circumstances (akin to sickness or damage), Freely will reimburse you as much as 150% of the price of the journey. Contemplating how typically flights are delayed and the way typically a pure catastrophe happens, it is a stable addition and one thing not a number of inexpensive plans embody.

Misplaced, Stolen, or Broken Baggage

Freely’s protection for misplaced or stolen baggage is much like different firms, in that there’s a per-item restrict of $500 USD and a complete cap of $2,500 USD. Whereas that’s good for lots of substances, akin to a fundamental digital digicam or sporting gear, it might not cowl the whole worth of a laptop computer or extra heavy-duty digicam.

Nevertheless, as I discussed above, you should buy an add-on for added protection. It will bump your baggage per-item restrict to $1,500 USD and the full restrict to $5,000 USD. Your digital {and professional} gear protection is $2,000 USD, which supplies substantial protection on your telephone or laptop computer.

Whereas the fee for this improve will fluctuate, utilizing the instance under (a month lengthy journey to Thailand), it will price round $23 USD for the add-on. That’s tremendous inexpensive.

Baggage Delay

This can be a good perk for anybody who isn’t touring carry-on solely. Basically, in case your baggage is delayed 12 hours or extra, you’ll qualify for as much as $250 USD so you should buy obligatory clothes and private gadgets (inside an affordable restrict). With Baggage Improve this profit may be elevated by $100 USD.

Observe: As with all insurance coverage plan, you’ll wish to learn the high quality print of your coverage for extra info. Moreover, particulars is likely to be completely different based mostly on the place you reside, so all the time double-check whereas researching simply to be secure.

What’s NOT Lined?

Freely is primarily geared towards protecting medical emergencies and fundamental journey mishaps (like delays and misplaced baggage). It’s good observe to let you know what’s not lined, akin to the next:

- Alcohol- or drug-related incidents

- Any electronics over $500 USD (with out an add-on)

- Sure high-risk actions (e.g., driving in a motorized vehicle competitors)

- Participation in skilled or newbie athletics competitions

- Losses incurred due to a pre-existing medical situation.

Should you’re unsure if the exercise you wish to do is roofed, or if you need extra details about what just isn’t lined, attain out to Freely immediately.

At the moment, Freely’s insurance policies can be found solely to residents of the US and Australia. Protection described on this article is particular to the US product.

How A lot Does Freely Price?

You may get a quote on-line at freely.me in lower than one minute. You simply must enter fundamental info, like the place you reside, the place you’re going, how lengthy you’re touring for, and the way a lot your journey prices.

For instance, somebody aged 30 going from the US to Thailand for one month can pay round $40 USD for base protection. That’s for a visit costing round $2,000 USD and never together with any extras or Every day Boosts.

Click on right here to get a quote from Freely.

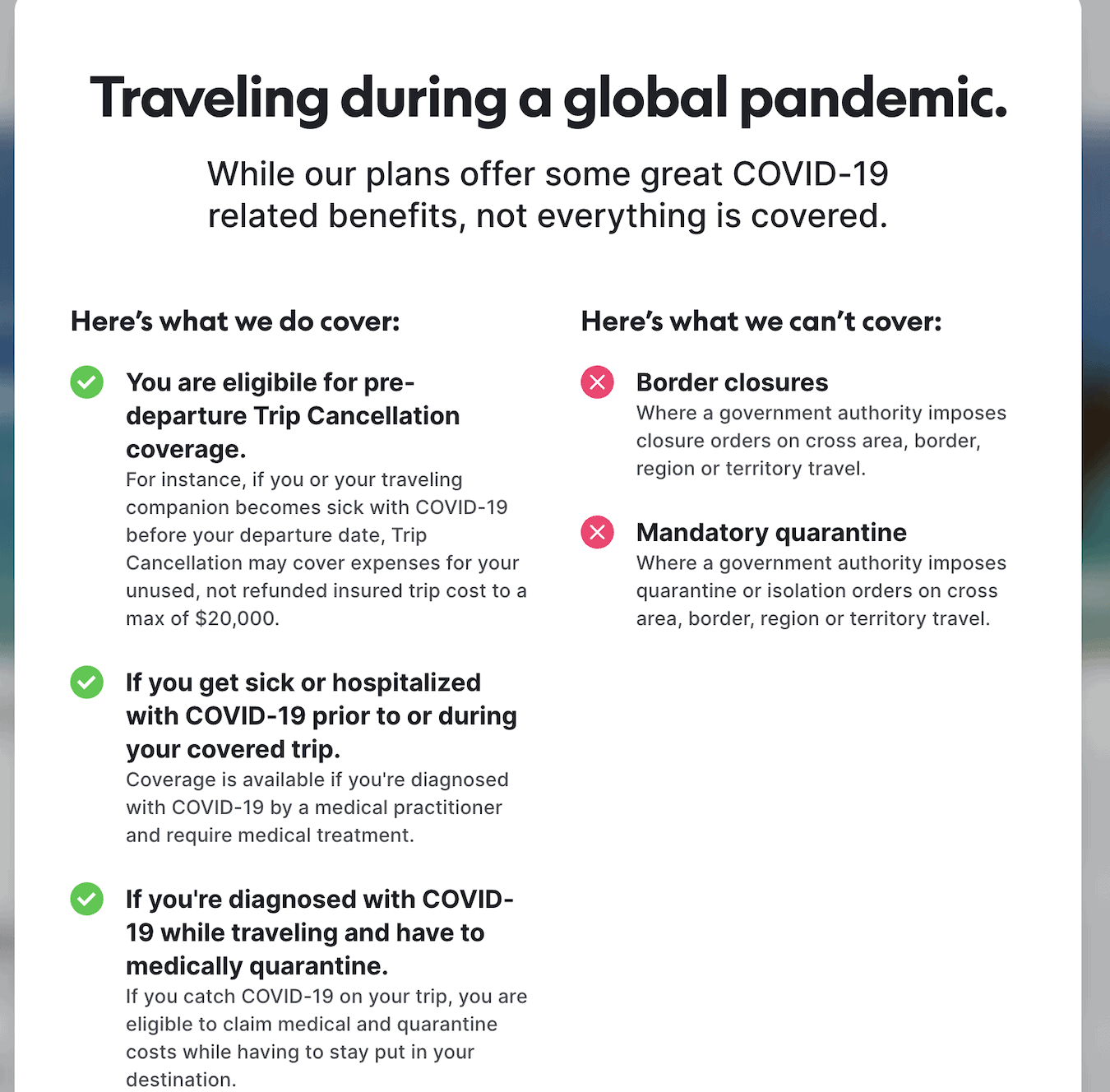

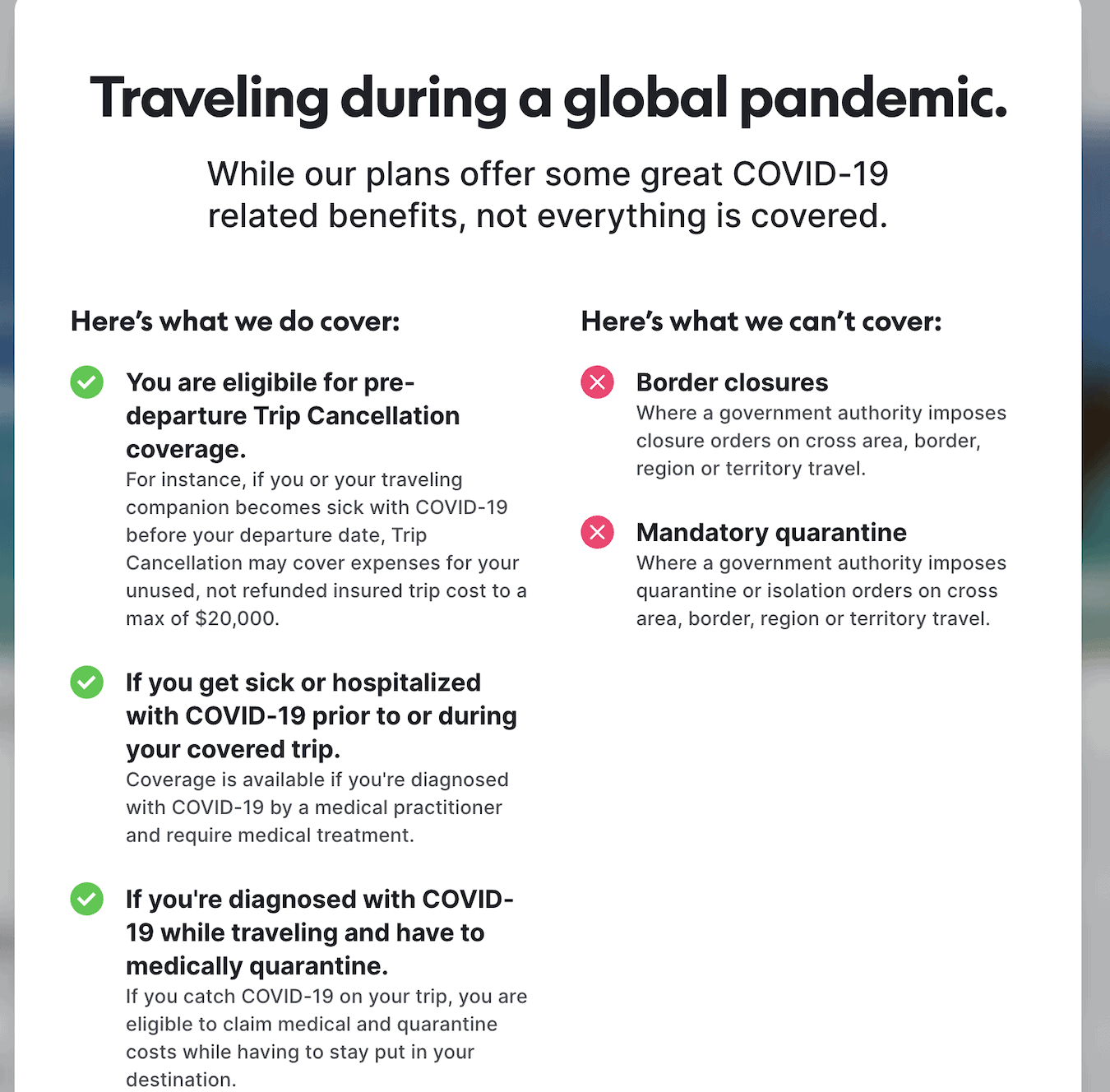

One factor I like about Freely relating to getting quotes is that they let you know what isn’t lined. A number of firms simply indicate that (i.e., if it’s not talked about, it’s not lined).

Freely, however, explicitly provides reminders of what’s not lined while you’re in search of a coverage, in order to make sure that your expectations are correct.

Execs of Freely

- 24/7 emergency help

- Emergency medical protection

- Emergency Evacuation and journey interruption protection

- Protection for misplaced, stolen, or broken baggage

- COVID protection

- Every day add-ons accessible for additional gear and actions

Cons of Freely

- Solely accessible within the US and Australia

- Downloading the app is required

Who’s Freely For — and NOT For?

Freely could be very inexpensive, making it a stable alternative for backpackers and funds vacationers. Lengthy-term vacationers who’re extra versatile with their plans may also respect with the ability to replace their coverage proper within the app.

It’s additionally an incredible alternative for adventurous vacationers since you may add Every day Boosts for issues like skydiving, scuba diving, and so forth.

Freely’s app additionally sends out security alerts and COVID updates, making it a superb possibility for these involved about issues of safety. As a result of Freely depends on an app, they’re capable of pinpoint your location to make sure vital native security updates get to you. I can’t consider one other insurance coverage firm that gives that type of service, making certain your peace of thoughts regardless of the place you’re going.

On the flip facet, Freely could also be irritating for anybody who doesn’t wish to obtain and use an app. Most of Freely’s providers (making a declare, altering or updating your coverage) are solely accessible within the app. Whereas this makes it streamlined and handy in some methods, those that need to have the ability to entry and handle their account on a pc may wish to select a unique firm.

I feel shopping for journey insurance coverage needs to be a easy and easy course of. Discovering a coverage shouldn’t be completely mind-numbing or time-consuming. And whereas Freely continues to be fairly new available on the market, it has a number of potential. Its app makes discovering the knowledge you want a breeze, and the extras and Every day Boosts add customization I hope extra firms embrace. I feel it’s a worthwhile firm to take a look at while you’re purchasing round for a plan.

Click on right here to be taught extra and get a quote in the present day!

E book Your Journey: Logistical Ideas and Tips

E book Your Flight

Use Skyscanner to discover a low-cost flight. They’re my favourite search engine as a result of they search web sites and airways across the globe so that you all the time know no stone is left unturned.

E book Your Lodging

You’ll be able to guide your hostel with Hostelworld as they’ve the largest stock and greatest offers. If you wish to keep someplace aside from a hostel, use Reserving.com as they constantly return the most affordable charges for guesthouses and low-cost accommodations.

On the lookout for the Greatest Corporations to Save Cash With?

Take a look at my useful resource web page for the most effective firms to make use of while you journey. I record all those I exploit to save cash once I’m on the street. They are going to prevent cash while you journey too.

Need to Journey for Free?

Journey bank cards permit you to earn factors that may be redeemed free of charge flights and lodging — all with none additional spending. Take a look at my information to choosing the right card and my present favorites to get began and see the most recent greatest offers.

Want Assist Discovering Actions for Your Journey?

Get Your Information is a large on-line market the place you could find cool strolling excursions, enjoyable excursions, skip-the-line tickets, non-public guides, and extra.