12 months so far, U.S. lodge efficiency has are available in a bit weaker than projected with demand nearly flat (+.1 %) and RevPAR progress at +1.1 %. With modest provide progress pushing occupancy comparisons to unfavourable territory (–.5 %), there was much less alternative to drive whole revenues as whole income per out there room (TRevPAR) is down .3 %.

After three consecutive months of slower labor progress, labor prices are again on the rise with a 5.7 % enhance in labor per out there room (LPAR). Decrease TRevPAR and better working bills (particularly labor) have led to exaggerated declines in gross working revenue per out there room (GOPPAR), which is down 8.9 %.

One noteworthy optimistic within the metrics is group enterprise performing above final yr with a continuation of the bifurcation pattern that has been taking part in out. Higher upscale and upscale chains have grown RevPAR by greater than 1 %, whereas progress for luxurious chains (+.2 %) has been extra muted. Improved demand for teams has meant extra income alternative exterior of the rooms division, particularly meals & beverage.

Complete F&B revenues are up 1.4 % in comparison with final yr and presently sit at 106.9 % of 2019 ranges. When accounting for inflation, F&B revenues are at 87.9 % of 2019 ranges. The largest F&B income progress has been with different F&B, which has elevated 7.6 % on a PAR foundation and consists of non-consumable F&B objects like A/V prices and room leases. Meals gross sales PAR has realized the second highest progress at +6.4 %. Nonetheless, with progress in revenues comes progress in bills, which have risen at a a lot quicker fee than revenues. Complete F&B bills PAR have been up 9.6 % yr over yr, with the most important contributor being labor (+5.1 %).

Specializing in simply full-service properties within the luxurious, higher upscale, and upscale courses, F&B revenues PAR are up 7.5 % yr over yr, whereas bills are up solely 3.4 %. The upper-upscale class has realized the biggest progress yr over yr in revenues PAR (+5.8 %), boosted primarily by sturdy progress in different F&B (+7.7 %) and meals (+6.6 %).

Though there’s constant sturdy progress amongst F&B revenues for these three courses, progress charges are stronger on the expense aspect and have restricted the chance for margin progress. Margins for these courses are a mean of 1.6 factors decrease than 2019 and 1.7 factors decrease than 2023. Once more, labor is taking part in a serious position in decrease margins as F&B labor for these three courses is up $10 per occupied room (POR), which is a 26.3 % enhance since 2019.

Prime 25 Markets

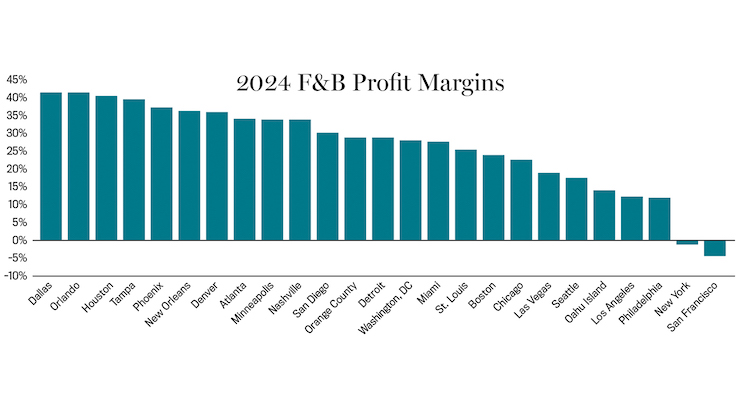

A lot of the labor stress tends to come back from larger markets, and though the Prime 25 Markets have been outperforming all different markets, their bills are inclined to replicate that larger demand. F&B revenues PAR within the Prime 25 Markets is up 4.4 % for all properties and 6.1 % for full-service properties, whereas their bills are up 8.5 % and 6.9 %, respectively. Dallas, Atlanta, and Nashville are realizing the very best progress in F&B revenues, whereas San Francisco, New York Metropolis, and Philadelphia are reporting the bottom F&B revenue margins. Solely eight of the Prime 25 Markets are realizing larger revenue margins than final yr.

The Want for Creativity

In any trade, stress drives creativity, and the lodge trade is not any exception. Lodges have been getting extra environment friendly at making a eating expertise for company that can be conscious of margins. Know-how is one instrument on this effort, and accommodations are utilizing it to scale back waste, enhance scheduling, and alleviate stress on workers. Moreover, lodge eating places are elevating the eating expertise to draw high-end lodge company and locals. Together with this effort, they’re curating their menu and downsizing choices to allow them to give attention to offering the perfect eating expertise attainable in hopes of driving revenue margins.