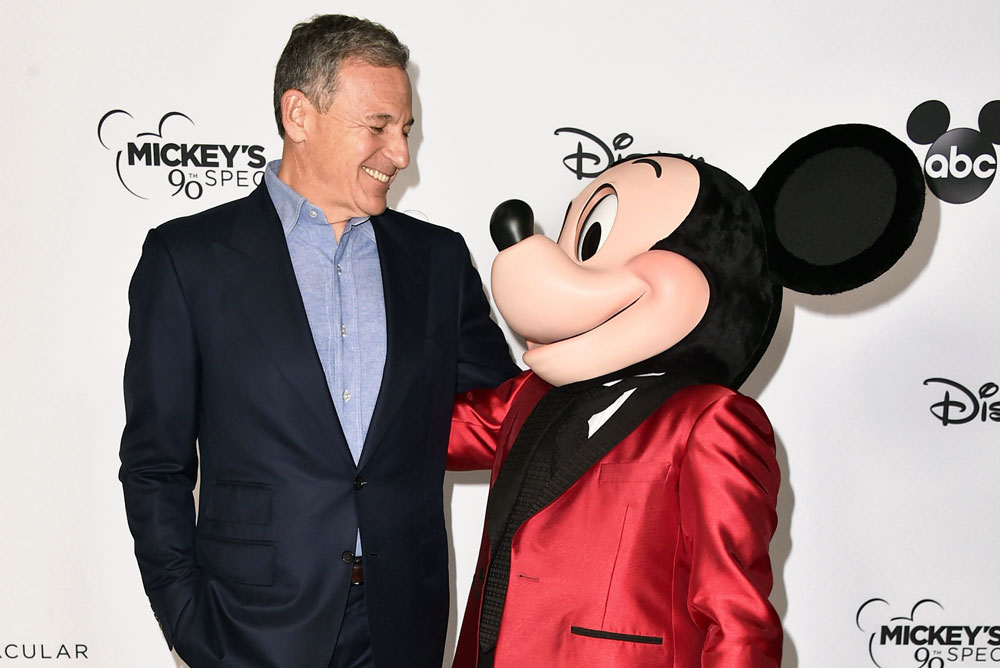

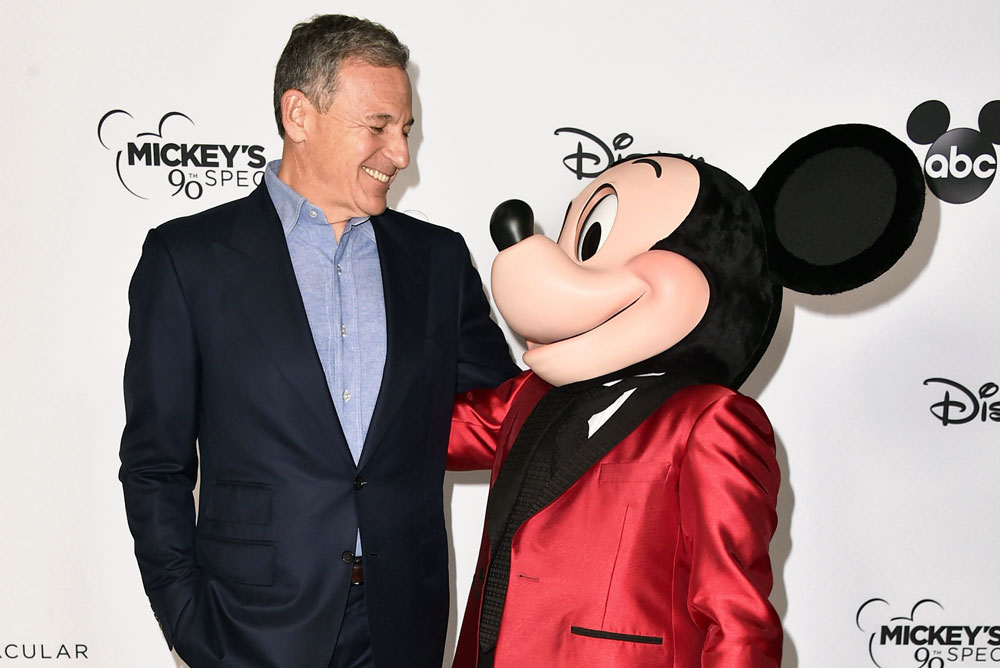

The Walt Disney Firm’s proxy battle with Trian Group (and, I assume, Blackwells Capital) is over. CEO Bob Iger and the present board have prevailed over Nelson Peltz and Jay Rasulo (and whoever Blackwells proposed). This discusses our ideas in regards to the vote and what it means for the way forward for Walt Disney World and Disneyland investments.

The result of the vote was introduced in the course of the Walt Disney Firm’s 2024 Annual Assembly of Shareholders on April 3, 2024. Disney introduced that the corporate’s slate was elected by a “substantial margin” over each the Trian and Blackwells slates. The precise outcomes weren’t reported, however might be within the coming days as numbers are finalized.

This adopted months of an more and more hostile proxy battle. Within the dwelling stretch, Peltz and Rasulo did interviews and roundtables that took a much less deferential tact in the direction of Bob Iger and struck a far much less cordial tone. Removed from harmless within the ordeal, the Mouse took the gloves off, so to talk, with their very own movies and collateral that solid aspersions on Peltz and Rasulo.

The Walt Disney Firm introduced that its full slate of 12 administrators has been elected by a considerable margin over the nominees of Trian and Blackwells at Disney’s 2024 Annual Assembly of Shareholders right this moment. Closing voting tallies are topic to certification by the Firm’s impartial inspector of elections, and preliminary and ultimate outcomes might be included within the Firm’s reviews to be filed with the Securities and Alternate Fee within the coming days.

Shareholders voted to elect all 12 nominees really useful by the Disney Board: Mary T. Barra, Safra A. Catz, Amy L. Chang, D. Jeremy Darroch, Carolyn N. Everson, Michael B.G. Froman, James P. Gorman, Robert A. Iger, Maria Elena Lagomasino, Calvin R. McDonald, Mark G. Parker, and Derica W. Rice.

“We’re immensely grateful to our shareholders for his or her funding in Disney and their perception in its future, notably throughout this era of nice change within the broader leisure trade. We’re lucky to have a extremely certified Board of Administrators who possess a profound dedication to the enduring energy of this firm and an infinite quantity of expertise and experience, together with succession planning. I’m grateful for Bob and his distinctive administration workforce, in addition to Disney’s workers and Solid Members all over the world, for persevering with to ship for shoppers and shareholders all through this distracting proxy battle,” stated Mark Parker, Chairman of the Board, The Walt Disney Firm.

“I need to thank our shareholders for his or her belief and confidence in our Board and administration. With the distracting proxy contest now behind us, we’re wanting to focus 100% of our consideration on our most essential priorities: development and worth creation for our shareholders and inventive excellence for our shoppers,” stated Bob Iger, Chief Govt Officer, The Walt Disney Firm.

The waning week of the battle for the board additionally noticed leaks of vote totals. The Wall Road Journal reported that Trian was forward when simply over 22% of votes had been solid final week, largely by particular person and different smaller buyers. In response to the WSJ reporting, a spokesman for Disney stated leaking an early vote depend was “a extremely inappropriate try and sway votes.”

Then this week introduced one other report from the WSJ that Disney was profitable with over half of votes solid and one other from Reuters that sufficient votes had been solid that Disney had safely secured victory. It stands to purpose that institutional buyers are what pushed Disney excessive and had been the end result determinative issue between final week and this week.

Vanguard owns 7.8% of Disney shares and voted in favor of Disney’s slate. BlackRock, Disney’s second-largest shareholder with 78 million shares, supported Disney. With 9.3 million Disney shares, T. Rowe Value additionally introduced they assist Disney. That left solely State Road and Geode Capital Administration, the corporate’s third and fourth-largest shareholders, as unknowns.

Against this, billionaires Invoice Ackman and Elon Musk, who personal a mixed 0% stake in Disney, each endorsed Nelson Peltz within the eleventh hour of the proxy battle. Activist investor Ackman wrote in a prolonged tweet that Peltz could be “drastically additive” as a member of the board. He referred to as the leaked votes “extremely inappropriate” and said as undeniable fact that Disney had leaked the vote complete to affect the vote. (Observe that the early voting leaked each when Disney was down and up, and Disney additionally complained about it.)

I’m no billionaire genius, however I feel it’s pretty secure to attract conclusions based mostly on Vanguard and BlackRock together with different institutional buyers supporting Disney. It could have taken a reasonably insurmountable early lead amongst small shareholders to beat the institutional assist for Iger.

Don’t really feel too badly for Nelson Peltz, as a result of on this battle, everybody wins. That is Trian’s second proxy battle with Disney, with this one beginning solely days after the corporate’s inventory reached a 52-week low. Since Peltz and Trian referred to as off the unique Save Disney remake final spring, Disney’s inventory worth tumbled from round $113 per share to round $80, the bottom degree in a decade. Therefore the proxy fights within the first place.

The day earlier than the shareholder’s assembly, Disney shares closed at $122.82. That’s up 55% from the aforementioned low of $80. The inventory has jumped 36% yr thus far, in comparison with a 9% achieve for the S&P 500. Peltz purchased most of his shares on the decrease finish of that vary, and has profited tremendously on the gambit, even after accounting for the pricey proxy battle itself.

A number of disenchanted Disney followers are going to be disenchanted with this final result. I do know this each as a result of we’ve heard from lots of them, and the primary WSJ article with the leaked vote complete strongly instructed the identical. Particular person buyers and small shareholders–lots of whom are followers or former Solid Members–had been giving Peltz and Trian a slight edge. They weren’t doing that as a result of they love Bob Iger and the present board!

Whereas I personally don’t agree with them, I can perceive this attitude. We’ve heard from numerous jaded (former) followers within the final a number of years, sad with Disney’s route for any variety of causes. Even for those who disagree with this and assume Disney is by some means higher than ever, it’s inconceivable to dispute that this sentiment is widespread and underpinned by a number of causes. Look no additional than Is Disney Ruining Its Status? and Disney’s Status Falls Additional for protection of the corporate’s self-inflicted model injury and lack of fan goodwill consequently.

There was a short little bit of renewed hope when Chapek was ousted and Iger returned, however that honeymoon ended early–most likely by this level final yr–as followers didn’t see the modifications they wished. Though Bob Iger and present administration have made some noticeable enhancements, the consensus is that it’s too little and too sluggish. Together with that, Iger is more and more drawing extra criticism for previous missteps.

To that, we’d first remind readers of one thing we stated many instances in the course of the phased reopening–that Disney is a giant ship that turns slowly. There’s no flipping a change–every thing takes time. Typically, an excessive amount of time. But additionally and in equity, you’re by no means going to see the entire modifications you need.

But additionally and in equity (once more), you had been by no means going to see the entire modifications you need underneath Nelson Peltz or Jay Rasulo both. A part of the attraction of the proxy battle is that Trian by no means actually introduced a transparent imaginative and prescient for the way forward for Disney. The proposals had been sufficiently imprecise and open-ended; followers might mission their very own needs and needs onto them. Perhaps Peltz could be the one to convey again free FastPass, Disney’s Magical Categorical, or a sure kind of content material once more. Why not? He by no means stated he wouldn’t!

Just one little drawback with that: Nelson Peltz is a self-interested activist investor with one and just one objective: growing the share worth and in flip maximizing the worth of his funding. It’s attainable that his targets align with followers–these of buyers and followers should not essentially mutually unique.

To make sure, there are issues Peltz stated in the course of the proxy battle that I actually preferred! I agree with among the points he recognized with Disney! However I used to be additionally skeptical he had any precise plan. (I can establish issues–doesn’t imply I’m able to fixing ’em.) Even in its present type as a behemoth multinational company, Disney is a uniquely inventive enterprise. It’s simply totally different than different firms, and I didn’t relish the thought of an activist investor on the board. (Form of a fox guarding the henhouse situation.) Furthermore, it’s delusional for any fan want record to incorporate the phrases “free” or “decrease costs” when it got here to this proxy battle. That was by no means a conceivable final result.

As I’ve stated many instances–and I nonetheless consider this–I feel the proxy battle itself was a great factor. I do assume Bob Iger and the present board had change into complacent. That there was a scarcity of focus and accountability, and that the board was on autopilot to some extent. I feel a better sense of urgency was wanted in a number of regards, together with runaway spending on streaming and films in addition to lax succession planning and being extra cognizant of visitor satisfaction within the parks.

It’s arduous to say whether or not this was a pure consequence of Iger’s return or a strategy to fend off the fights, however Disney did undertake a couple of of the modifications instructed by Peltz–beginning early final yr on the outset of the primary proxy battle. The corporate is spending far much less on content material now (and streaming loses have narrowed consequently). A number of shake-ups have occurred with the board during the last yr to have better construction and concentrate on succession planning. Main modifications had been made to enhance visitor satisfaction and worth at Walt Disney World and Disneyland.

Loads has occurred within the final yr, however our major focus is theme parks, so the large factor that stands out to us is the corporate revealing that it’ll spend $60 billion over the subsequent decade to develop and improve Walt Disney World, Disneyland, Disney Cruise Line, and its worldwide theme parks. This represents almost double the quantity invested during the last 10-year interval, as Disney seeks to “turbocharge” its theme parks in accordance with Iger and Parks Chairman Josh D’Amaro.

In the end, as somebody who may be very optimistic about that coming to fruition (extra on that quickly) and is bullish in regards to the 2024 D23 Expo bulletins, I’m glad Peltz and Rasulo fought…but in addition happy that they had been defeated. Long run, I’ve no clue whether or not Peltz or Rasulo would have had a constructive or unfavorable affect on Disney’s board. I don’t assume anybody actually does–all of us simply had hopes based mostly on our personal wishful pondering and biases in regards to the board and Bob Iger. And that features me!

Lengthy-term, my fear is that Peltz’s self-interest didn’t really align with mine as a fan, that he was simply saying what he wanted to say to get elected, and he’d make issues worse. Present administration is actually not excellent, however I do assume they really “get” Disney, what makes the corporate particular and in contrast to others, and try to do their greatest to navigate Walt’s legacy with calls for of Wall Road. However once more, I’m biased like anybody else.

My massive near-term concern is clearer and fewer speculative. That Peltz or Rasulo could be brokers of chaos on the board, throwing a monkey wrench into plans which have already been set into movement and resulting in phrases I’ve come to dread in the previous few years from Disney: “we’re reevaluating our plans for…”

The $60 billion for Parks & Resorts, together with $17 billion for Walt Disney World and at the very least $2.5 billion for Disneyland, is actual cash. There are actual plans for tips on how to spend it. Most essential of all, the final remaining hurdles have virtually all been cleared–free money movement is enhancing, different divisions are stabilizing, and points with Anaheim/California and Florida are both within the rearview mirror or might be inside the subsequent two months. Barring one thing catastrophic (and a brand new board might qualify), funding goes to start later this yr. The runway is evident…the very last thing I would like is a brand new air site visitors controller coming in and grounding all flights till he has the prospect to shake issues up and make his mark.

Want Disney journey planning ideas and complete recommendation? Be certain that to learn Disney Parks Trip Planning Guides, the place you’ll find complete guides to Walt Disney World, Disneyland, and past! For Disney updates, low cost info, free downloads of our eBooks and wallpapers, and rather more, join our FREE electronic mail e-newsletter!

YOUR THOUGHTS

What did you consider Bob Iger and the present board prevailing within the proxy battle? Would Nelson Peltz have been an awesome additive to the board or an agent of chaos? Assume this battle was helpful for the corporate and followers on the finish of the day? Optimistic that this has pushed Iger to lastly get critical about selecting a successor or concentrate on enhancing visitor satisfaction within the parks? Ideas on anything mentioned right here? Do you agree or disagree with our evaluation? This isn’t the place for politics or tradition wars; unnecessarily divisive or provocative feedback alongside these strains might be deleted.