Highlights

- U.S. ADR soared on the again of sturdy year-over-year progress in Miami and New York Metropolis.

- The constructive aspect of the Artwork Basel calendar shift drove progress in Miami.

- New York Metropolis led the nation in absolute RevPAR.

- China posted the most important RevPAR acquire, persevering with a 10-week development.

- New 12 months’s Eve demand the world over is predicted to be down barely in comparison with final 12 months as a result of vacation calendar shift from Saturday to Sunday. ADR will stay sturdy.

U.S. efficiency

U.S. lodge occupancy reached 58.7%, up 4.5 proportion factors (ppts) in comparison with the prior week as vacation leisure journey kicked in together with the return of end-of-year enterprise and conference journey. Occupancy, nevertheless, was down 0.7 ppts versus final 12 months. Common every day charge (ADR) elevated 4.5% 12 months over 12 months (YoY), leading to a 3.3% enhance in income per out there room (RevPAR). ADR has been driving RevPAR progress for many of 2023 whilst occupancy has slipped. That is extra proof of hoteliers persevering with to cost with a give attention to margins quite than occupancy.

Like in previous weeks, the Prime 25 Markets drove trade progress with RevPAR rising 5.8% on the again of a 6.6% ADR acquire. The weekend (Friday & Saturday) produced the most important RevPAR enhance (+7.8%), a reversal of the sample seen for a lot of the fall when weekdays (Monday-Wednesday) tended to be the strongest. Prime 25 weekday RevPAR grew 5.6% with shoulder days (Sunday & Thursday) up 3.5%. Within the remaining markets, RevPAR elevated 0.8%, all on ADR (+2.1%) as occupancy declined 0.7ppts. Not like for the Prime 25 Markets, weekdays confirmed the most important RevPAR acquire (+2.4) adopted by shoulder days (+0.5%).

As famous within the earlier week’s outcomes, Miami was anticipated to have a big influence on trade efficiency as a result of calendar shift of Artwork Basel. Miami RevPAR elevated 67.9% YoY and accounted for almost half of the nation’s RevPAR acquire, including 140 foundation factors to the outcome. Recall, one week earlier, Miami negatively impacted the nation. Artwork Basel 2022 started on 28 November with a lot of the actions happening over the weekend. This 12 months, the occasion started 4 December. When evaluating this week’s efficiency to the comparable week final 12 months, RevPAR declined 1.8%, probably impacted by the one-day shift within the occasion from Thursday-Saturday to Friday-Sunday. Miami efficiency within the subsequent week of information, particularly Sunday, will profit from this one-day shift.

Within the remaining Prime 25 Markets, New York Metropolis noticed its second highest RevPAR of the 12 months (the best was seen within the week when the U.N. Basic Meeting met). Occupancy within the Metropolis reached 89.9%, the fourth highest degree of the 12 months. This sturdy efficiency bodes effectively for New York Metropolis’s vacation season over the subsequent couple weeks with New 12 months’s Eve possible capping efficiency for the 12 months.

Three different markets this week, Anaheim, Boston, and San Diego every noticed RevPAR develop by 20% or extra. All three markets posted will increase in group occupancy. San Diego and Boston additionally recorded sturdy weekend efficiency with RevPAR rising 89.0% and 59.4%, respectively.

In comparison with final 12 months, group demand within the week was basically flat, nevertheless, the combination of weekday versus weekend and shoulder has modified. This 12 months, weekdays produced the best positive aspects, whereas weekends and shoulders declined barely, reflecting the altering mixture of group enterprise with extra enterprise and fewer leisure in comparison with final 12 months.

The highest lodge courses (Luxurious, Higher Upscale & Upscale) dominated the trade’s RevPAR progress with all three recording ADR and RevPAR will increase above 4%. Occupancy for all three was north of 65%. RevPAR in Higher Midscale section was up 0.7%, whereas Midscale accommodations fell 1.1%. Economic system accommodations continued to see falling RevPAR, dropping by 3.3%, which was the smallest decline of the previous 5 weeks.

International lodge efficiency

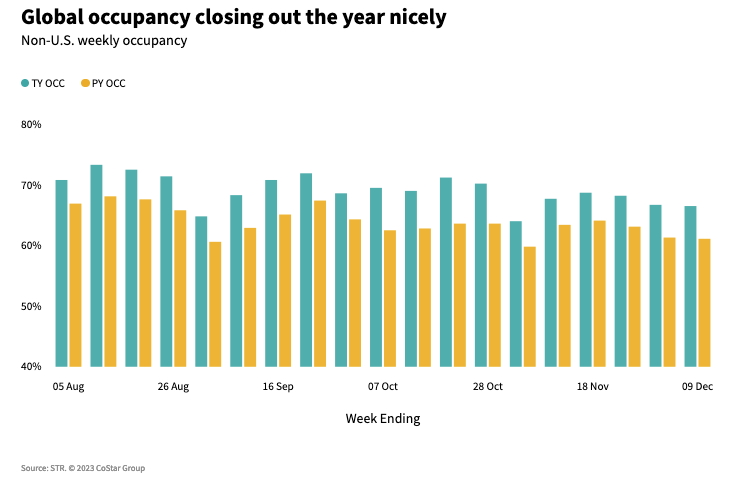

International occupancy, excluding the U.S., moved to 66.5%, up 5.3ppts YoY and flat from the earlier week. Occupancy is trending consistent with pre-pandemic norms as 2017, 2018 and 2019 all confirmed an identical slowdown of occupancy from mid-November towards the tip of the 12 months. International ADR (US$130) elevated 7.9% with RevPAR (US$87) rising 17.3% YoY; double-digit RevPAR progress has been the norm all 12 months lengthy, however the magnitude is trending down and has been within the excessive teenagers for the previous seven weeks. The summer time led to progress within the low-to-mid 20s.

Among the many high 10 nations, primarily based on provide, occupancy almost mirrored the globe with the measure up 6.9ppts YoY to 66.9%. Occupancy is nearing pre-pandemic ranges as the identical week in 2019 reached 67.6% and 2017 (which matches 2023 day for day) was 69.9%. Prime 10 ADR (US$116) grew 7.4% with RevPAR (US$78) rising 19.7% YoY.

Italy, which led the European contingent of the Prime 10 nations throughout the summer time (Could-August) with RevPAR progress of 18.1%, is now seeing some softening. In the newest week, the nation noticed RevPAR enhance 10.3% on an occupancy acquire of three.7ppts with ADR rising 3.1%. There was important variation within the nation with RevPAR in Tuscany down 31% however up 36.4% in Basilicata/Calabria/Puglia.

Because it has for the previous 10 weeks, China had the most important RevPAR acquire of the highest 10 nations with the measure rising 53.7%.

Trying forward

We anticipate ADR to stay sturdy for the remainder of the 12 months regardless of waning demand forward of the vacations. Outdoors the U.S., efficiency stays sturdy as nations proceed to get better. Nonetheless, progress charges are starting to reasonable and can possible return to regular ranges early subsequent 12 months.

All over the world, we count on demand to wane as the tip of 12 months approaches.

We additionally count on New 12 months’s Eve to be barely softer than final 12 months as a result of calendar shift from Saturday to Sunday with ADR remaining sturdy. As the brand new 12 months begins, occupancy on the books within the high U.S. markets is trending forward of final 12 months, indicating a robust begin to 2024.

This text initially appeared on STR.