Nomadic Matt has partnered with ThePointsGuy.com for our protection of bank card merchandise. Some or the entire card presents on this web page are from advertisers and compensation could impression how and the place card merchandise seem on the positioning. Nomadic Matt and ThePointsGuy.com could obtain a fee from card issuers.

Opinions, opinions, analyses & suggestions are the creator’s alone, and haven’t been reviewed, endorsed, or accredited by any of those entities. This web page doesn’t embrace all card firms or all obtainable card presents.

Phrases apply to American Specific advantages and presents. Enrollment could also be required for choose American Specific advantages and presents. Go to americanexpress.com to be taught extra.

I really like speaking about journey bank cards. They’ve helped me journey the world for over a decade and saved me a fortune in flights, inns, and different journey perks. I by no means get tired of evaluating their perks, making use of for brand new playing cards, and optimizing my advantages.

As of late, relating to journey rewards playing cards, there are usually two varieties that get a variety of consideration: playing cards with low or no annual charges which might be good for rookies; and premium playing cards for the jet set crowd, with their excessive charges and luxurious perks.

There aren’t too many playing cards that fall in between. At this time I need to discuss a card that does: the American Specific® Gold Card.

Whereas it’s a favourite amongst avid factors and miles collectors, it typically will get disregarded of the bigger dialog. I believe that’s a mistake, as this card has lots to supply.

The Amex Gold not too long ago acquired a refresh and an elevated welcome supply, making it a superb time to think about this powerhouse of a card. I personally assume it’s a card extra vacationers ought to have of their pockets and it’s one I take advantage of.

Right here’s the whole lot it’s essential know in regards to the Amex Gold that can assist you determine if it’s best for you:

What’s the American Specific® Gold Card?

The American Specific® Gold Card is a card issued by American Specific. I believe it’s an ideal selection for vacationers who get pleasure from eating out, as you’ll earn extra factors eating at eating places (as much as $50,000 on these purchases per calendar 12 months), in addition to a ton of assertion credit in the identical vein (I’ll get into specifics beneath).

With this card, you’ll earn Membership Rewards® factors, which you’ll switch to any of their 21 airline and resort companions (they’ve some strong companions too).

This card presents:

- 60,000 factors + earn as much as $100 again Earn 60,000 Membership Rewards® Factors after you spend $6,000 on eligible purchases in your new Card in your first 6 months of Card Membership. Plus, obtain 20% again in assertion credit on eligible purchases made at eating places worldwide throughout the first 6 months of Card Membership, as much as $100 again. Restricted time supply. Provide ends 11/6/24.

- Earn 4x Membership Rewards factors per greenback spent on purchases at eating places worldwide, on as much as $50,000 in purchases per calendar 12 months, then 1x factors for the remainder of the 12 months

- Earn 4x Membership Rewards factors per greenback spent at US supermarkets on as much as $25,000 in purchases per calendar 12 months, then 1x factors for the remainder of the 12 months.

- Earn 3x Membership Rewards factors per greenback spent on flights booked immediately with airways or on AmexTravel.com

- Earn 2x Membership Rewards factors per greenback spent on pay as you go inns and different eligible purchases booked on AmexTravel.com

- Earn 1x Membership Rewards level per greenback spent on all different eligible purchases.

- As much as $524 price of assertion credit (which I’ll break down beneath)

- No overseas transaction charges

The cardboard comes with a $325 annual payment (See Charges and Charges).

Breaking Down the Amex Gold’s Assertion Credit

American Specific is thought for providing a variety of perks and advantages with its playing cards (that’s why I really like their playing cards). As I discussed, this card comes with as much as $524 price of assertion credit. In case you can reap the benefits of them, that’s greater than sufficient to offset the annual payment. Since there are such a lot of credit (all with their very own superb print), I need to break each down.

As much as $120 in Uber Money

That is in all probability the simplest profit for most individuals to make use of. Once you add your Gold Card to the Uber app, you’ll get $10 in Uber Money distributed every month, (including as much as $120 over the course of the 12 months). You should utilize it for rides or to order meals by means of Uber Eats, although I don’t love you could solely use it within the U.S. since I’m typically on the street.

Earlier than your buy, make it possible for Uber Money is toggled on as a fee methodology, after which after your buy you’ll see the credit score deduction in your in-app receipt.

You need to have downloaded the most recent model of the Uber App and your eligible American Specific Gold Card have to be a way of fee in your Uber account. The Amex profit could solely be utilized in United States.

As much as $120 Eating Credit score

On the flip aspect, I discover this profit a bit more durable to make use of. You may earn as much as $10 in assertion credit month-to-month whenever you pay with the Amex Gold Card at Grubhub, The Cheesecake Manufacturing unit, Goldbelly, Wine.com, and 5 Guys. I believe it’s type of a random assortment of firms, however in case you use any of those firms typically, that’s one other $120 per 12 months proper there.

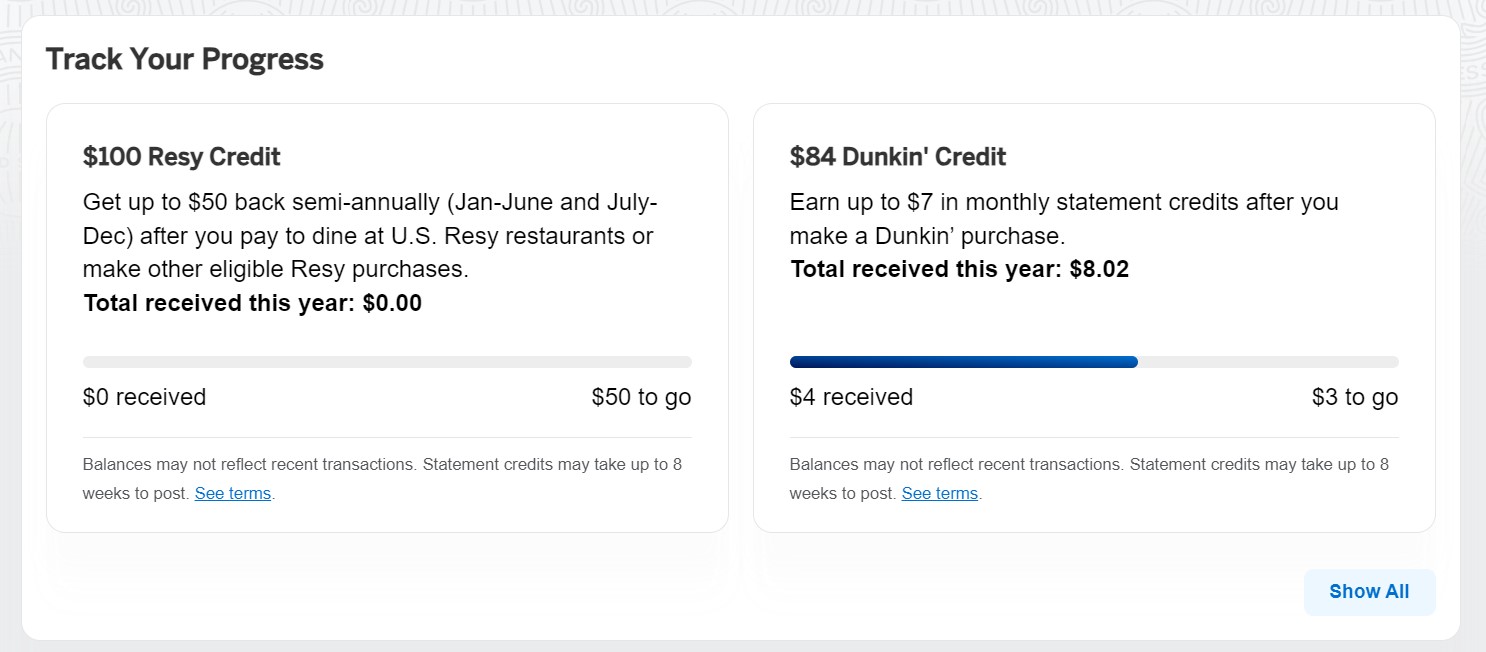

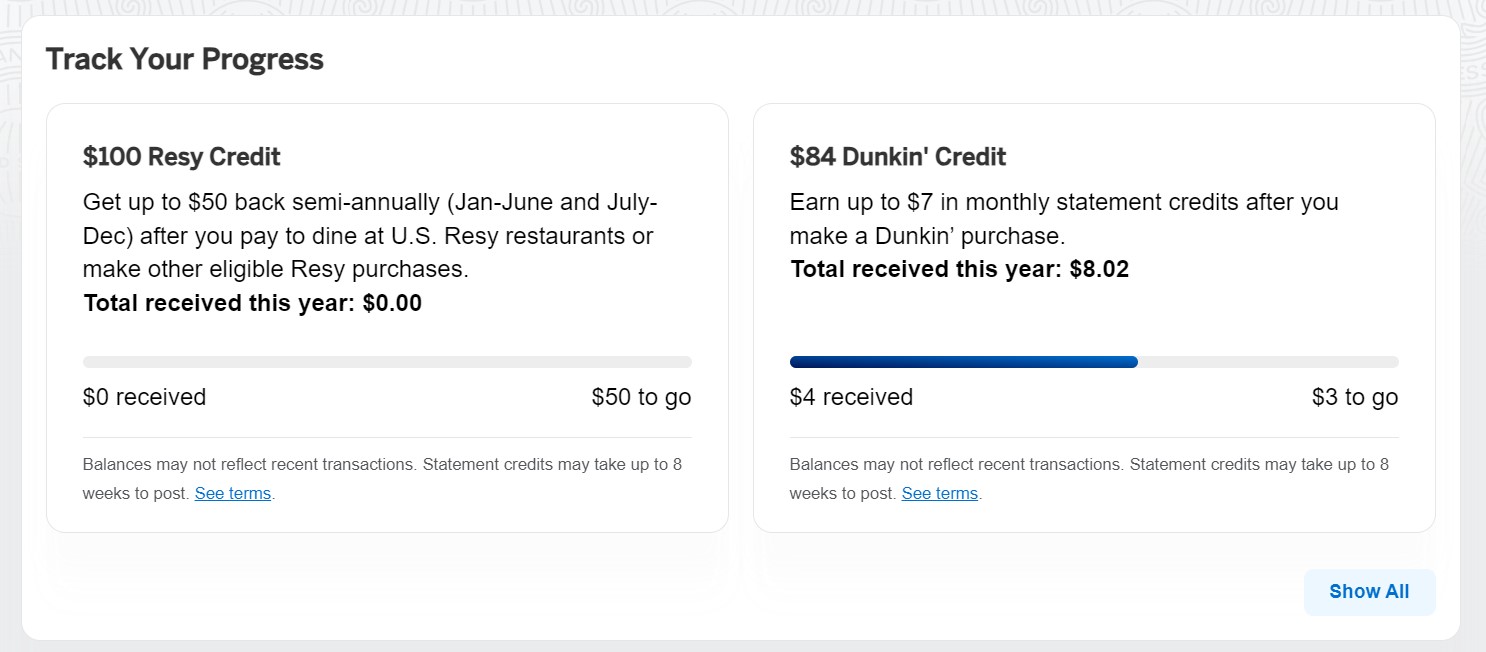

As much as $84 Dunkin’ Credit score

This profit was added with the cardboard’s latest refresh. In case you’re a fan of Dunkin’, with this credit score you’ll be able to earn as much as $7 in month-to-month assertion credit after you enroll and pay along with your Amex Gold Card at Dunkin’ places. Since most are on the U.S. East Coast (New York, New Jersey, Connecticut, and Florida have essentially the most places), it’ll be most helpful to fellow East Coasters.

As much as $100 Resy Credit score

That is one other profit that was not too long ago added. Resy is a restaurant-reservation web site (owned by Amex) the place you can also make reservations at over 16,000 eating places around the globe.

With the Resy credit score, you’ll be able to stand up to $100 in assertion credit every calendar 12 months after you pay along with your Gold Card to dine at U.S. Resy eating places (or make different eligible Resy purchases). Not like a lot of the card’s different assertion credit, this profit is rolled out semi-annually, which means you stand up to $50 credit score within the first half of the 12 months, after which the opposite $50 the second half. It’s also possible to test your progress within the app or web site:

I like semi-annual assertion credit as a result of they offer you a bit extra flexibility, though that is one other credit score that’s pretty simple to make use of in case you dine out incessantly. You don’t truly should make a reservation with Resy; the restaurant simply wants to supply Resy reservations. It’s best in case you dwell in or incessantly go to a serious metropolis that has a variety of eating places on Resy.

As much as $100 resort expertise credit score

That is the cardboard’s solely journey assertion credit score. With this profit, you’ll be able to obtain a $100 credit score in direction of eligible fees with each reserving of two nights or extra by means of AmexTravel.com. Eligible fees range by property, however it may embrace eating credit (like complimentary breakfast) or spa remedies.

Enrollment is required for choose advantages talked about on this part.

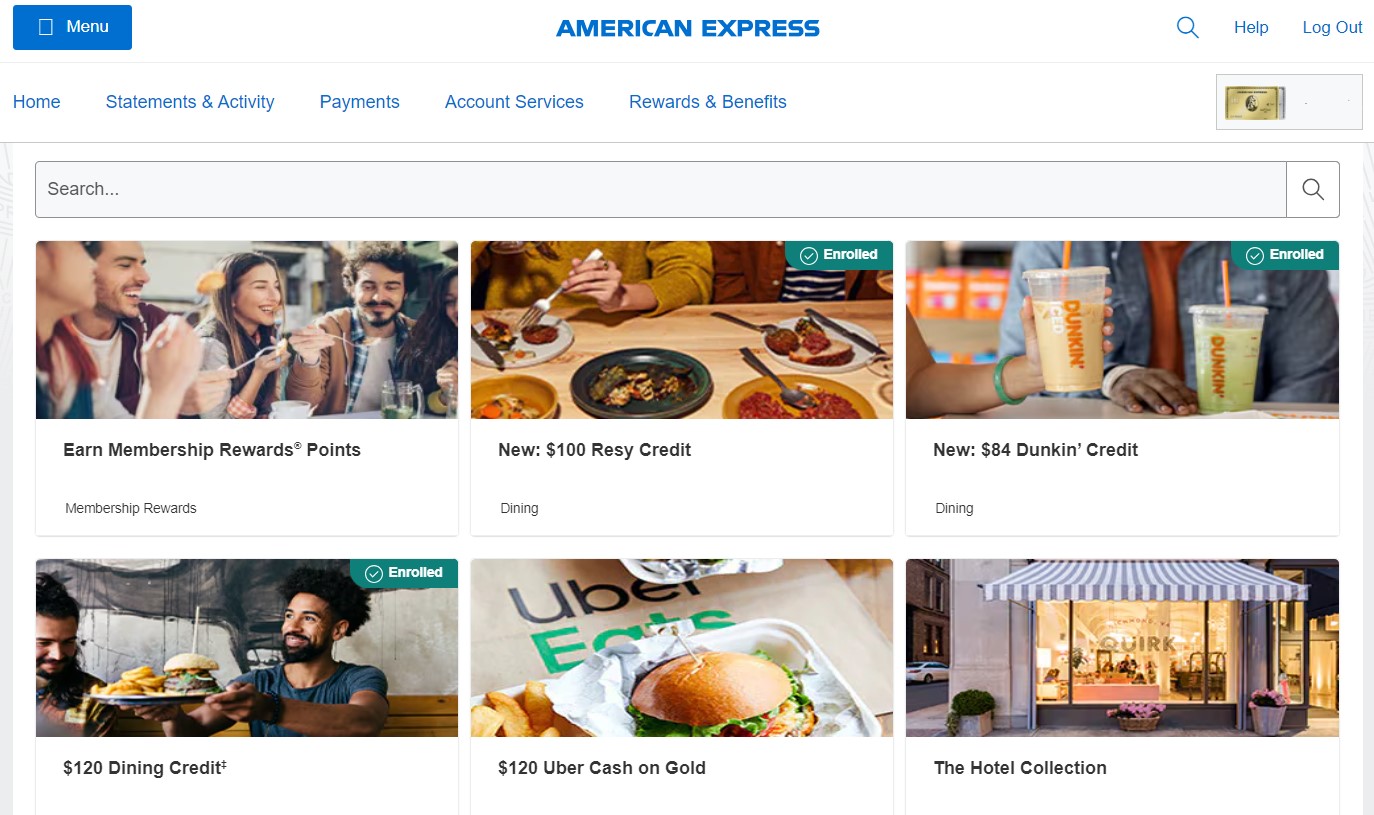

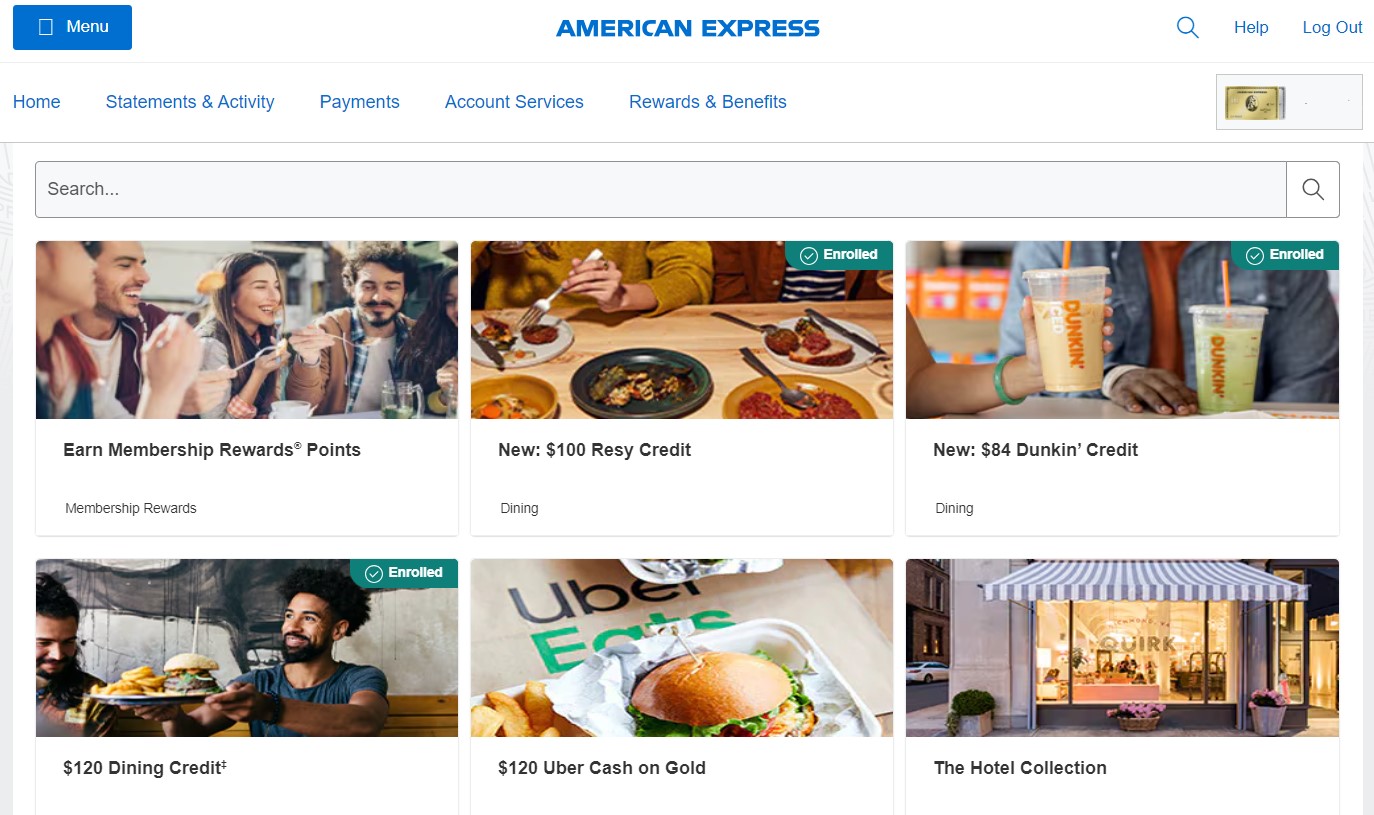

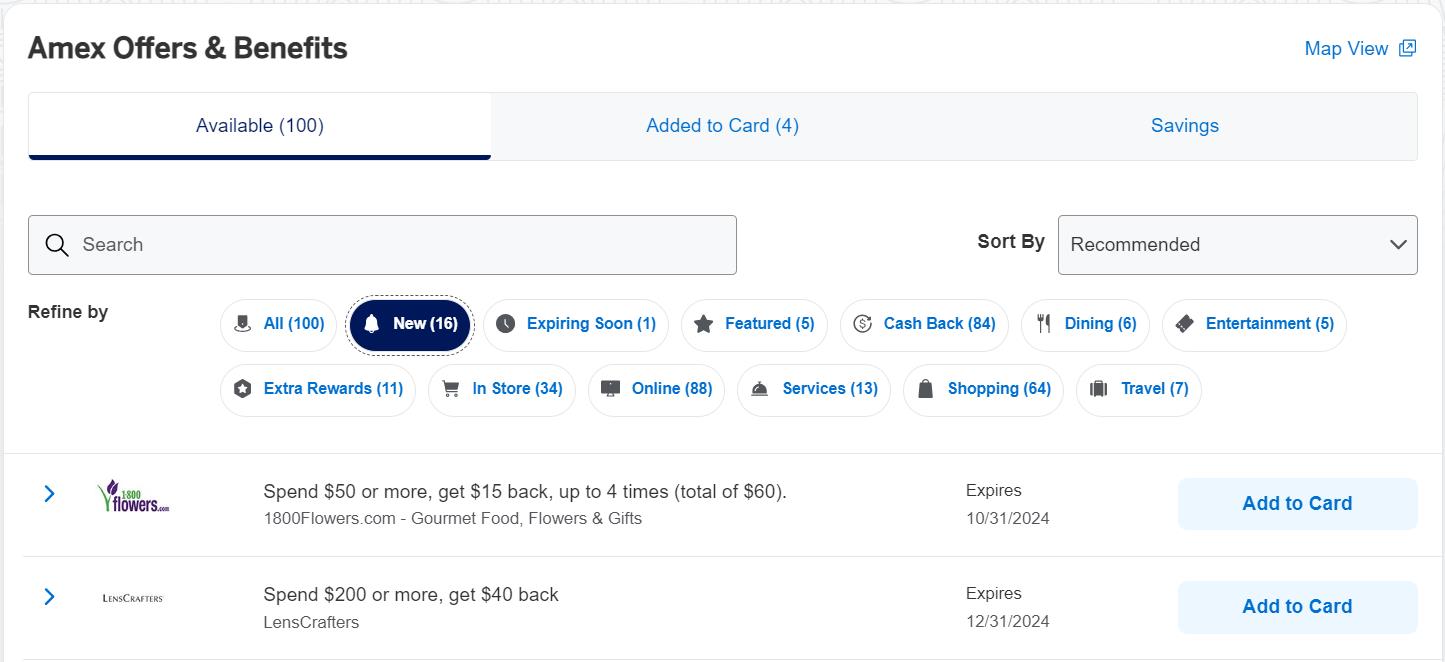

Entry to Amex Affords

Along with all these assertion credit, by holding an American Specific card you get entry to Amex Affords. These are ever-changing presents the place it can save you cash or earn bonus factors with choose retailers. The presents are focused, so each cardholder has their very own distinctive array of presents at any given time.

Amex Affords are structured like this:

- Spend X, get Y quantity again (like within the screenshot above; this is almost all of Amex Affords)

- Spend X, get Y variety of bonus factors

- Get extra Membership Rewards factors per greenback you spend at that retailer (i.e. get 5 MR factors per greenback you spend at The Hole)

- Get X% again whenever you use the hyperlink offered

It’s necessary to know that it’s important to hit that “Add to Card” hyperlink earlier than you’ll be able to reap the benefits of every supply. Whilst you in all probability received’t be capable to reap the benefits of most presents, generally you might, which is one other solution to recoup the annual payment on this card. It’s price it to test again on occasion so you’ll be able to add any presents to your card that you simply would possibly use (simply keep in mind to pay along with your Gold Card to redeem the supply).

Utilizing Your Membership Rewards Factors

With the American Specific® Gold Card, you earn Membership Rewards factors. To get essentially the most out of your factors, you’ll need to switch them to certainly one of Amex’s journey companions:

- Aer Lingus AerClub (1:1 ratio)

- Aeromexico Rewards (1:1.6 ratio)

- Air Canada Aeroplan (1:1 ratio)

- Air France-KLM Flying Blue (1:1 ratio)

- All Nippon Airways Mileage Membership (1:1 ratio)

- Avianca LifeMiles (1:1 ratio)

- British Airways Government Membership (1:1 ratio)

- Cathay Pacific Asia Miles (1:1 ratio)

- Selection Privileges® (1:1 ratio)

- Delta SkyMiles (1:1 ratio)

- Emirates Skywards (1:1 ratio)

- Etihad Visitor (1:1 ratio)

- HawaiianMiles (1:1 ratio)

- Hilton Honors (1:2 ratio)

- Iberia Plus (1:1 ratio)

- JetBlue TrueBlue (250:200 ratio)

- Marriott Bonvoy (1:1 ratio)

- Qantas Frequent Flyer (1:1 ratio)

- Singapore KrisFlyer (1:1 ratio)

- Virgin Atlantic Flying Membership (1:1 ratio)

Most transfers are prompt, although just a few (like Iberia and Cathay Pacific) can take as much as 48 hours.

It’s also possible to use your Membership Rewards factors to ebook flights and inns in Amex Journey, the journey portal. Although, as I’ve talked about earlier than, this isn’t the perfect use of your factors. I usually wouldn’t do it.

American Specific Welcome Bonus Restrictions

Not like different firms (like Chase), American Specific solely lets you earn a welcome bonus as soon as per card. Ever. Plus, you’ll be able to’t earn a welcome bonus on a card in any respect if you have already got (or have held) the next tier card in the identical household.

For the Amex Gold Card, meaning you received’t be capable to get the welcome supply if you have already got The Platinum Card® from American Specific.

I’m mentioning this as a result of it’s necessary to consider if you wish to get different Amex playing cards finally. Which means that for American Specific playing cards, it’s finest to open playing cards shifting up within the meals chain, so to talk (so get the Gold Card earlier than the Platinum Card).

Execs of the Amex Gold

- Excessive incomes charges at eating places, US supermarkets, and on flights (when booked immediately or by means of AmexTravel)

- Plenty of assertion credit

- Entry to Amex Affords

Cons of the Amex Gold

Who’s the Amex Gold for?

The principle draw of this card is having the ability to earn 4x factors on eating places worldwide and U.S. supermarkets. It stands alone in that facet amongst playing cards with transferable factors (essentially the most helpful type of factors). In case you are a foodie that may make use of the credit and different perks, then you definitely’ll love this card.

In case you’re an avid traveler, this card is finest used together with different playing cards (slightly than as the one card in your pockets). It might pair properly with one other card that earns 3x on all journey and has extra sturdy journey advantages (such because the Chase Sapphire Most well-liked® Card or the Chase Sapphire Reserve®). Plus, you’ll diversify your rewards into two of essentially the most helpful factors currencies: Amex’s Membership Rewards and Chase’s Final Rewards.

As with all bank card, you shouldn’t get this card in case you’re already carrying a steadiness or plan to hold a steadiness. Rates of interest for journey bank cards are notoriously excessive, and this card is not any totally different. The factors simply aren’t price it in case you’re paying curiosity every month.

This card can also be not for anybody with poor credit score, as you want wonderful credit score to qualify. (If that’s you, try finest bank cards for bad credit report so you can begin enhancing your rating immediately.)

In case you’re a foodie like me and spend a good portion of your price range on meals, the American Specific® Gold Card is a good card so as to add to your pockets. By racking up extra factors at eating places around the globe and U.S. supermarkets, you need to use the spending that you simply already do to earn your self flights and resort stays around the globe. And that’s what it’s all about!

Ebook Your Journey: Logistical Ideas and Methods

Ebook Your Flight

Discover a low-cost flight by utilizing Skyscanner. It’s my favourite search engine as a result of it searches web sites and airways across the globe so that you all the time know no stone is being left unturned.

Ebook Your Lodging

You may ebook your hostel with Hostelworld. If you wish to keep someplace aside from a hostel, use Reserving.com because it persistently returns the most affordable charges for guesthouses and inns.

Don’t Overlook Journey Insurance coverage

Journey insurance coverage will shield you in opposition to sickness, harm, theft, and cancellations. It’s complete safety in case something goes mistaken. I by no means go on a visit with out it as I’ve had to make use of it many instances prior to now. My favourite firms that provide the perfect service and worth are:

Wish to Journey for Free?

Journey bank cards permit you to earn factors that may be redeemed without cost flights and lodging — all with none additional spending. Try my information to choosing the right card and my present favorites to get began and see the most recent finest offers.

Want Assist Discovering Actions for Your Journey?

Get Your Information is a large on-line market the place yow will discover cool strolling excursions, enjoyable excursions, skip-the-line tickets, personal guides, and extra.

Able to Ebook Your Journey?

Try my useful resource web page for the perfect firms to make use of whenever you journey. I checklist all those I take advantage of once I journey. They’re the perfect at school and you’ll’t go mistaken utilizing them in your journey.