Highlights

- U.S. RevPAR moderated after three unsteady weeks.

- Prime 25 Markets and upper-tier motels led U.S. RevPAR positive aspects.

- Weekly group demand reached new heights.

- World leisure demand starting to bloom.

U.S. Efficiency

U.S. resort efficiency leveled out following three unstable weeks impacted by the entire photo voltaic eclipse and Easter calendar shift. Regular patterns returned within the type of stable weekday and Prime 25 Market efficiency, in addition to sturdy group demand. Income per out there room (RevPAR) rose 1.2% yr over yr (YoY) pushed fully by common every day price (ADR), up 1.5%. Occupancy (at 66.8%), the best stage seen in 2024 to this point, was basically flat dropping 0.2 proportion factors (ppts) YoY.

Weekdays proceed to put up the strongest efficiency whereas weekends stay tender

Weekdays (Monday by way of Wednesday) posted one of the best efficiency with all three days seeing a roughly 3% RevPAR acquire, all from ADR. The shoulder interval (Sunday & Thursday) adopted with RevPAR will increase of practically 1.5% every day, once more pushed by ADR. Weekends (Friday/Saturday) have been tender many of the yr with Saturday (RevPAR, -2%) down greater than Friday (-0.2%). Over the previous 15 weeks, (week one was excluded as a result of New Yr’s Eve impression), common RevPAR change by day adopted a steadily lowering sample from Monday (+3.4%) to Saturday (-1.2%). Sunday, nonetheless, was the outlier (+2.6%). This tidy sample is probably a mirrored image of journey patterns altering as prolonged leisure weekends decline as a result of waning pent-up demand whereas prolonged enterprise weekdays improve as a result of rising versatile work schedules.

Prime 25 Markets acquire RevPAR whereas the remainder of the nation posted larger ADR

The Prime 25 Markets noticed RevPAR improve 1.6% as a result of a raise in ADR (+1.0%) and occupancy (+0.4ppts). The remainder of the nation noticed a smaller RevPAR improve (+0.9%), lifted by a bigger ADR improve (+1.7%), however offset by an occupancy decline of 0.5ppts. The day-of-week shifts described above for the entire nation typically adopted the identical sample when evaluating the Prime 25 Markets to the remainder of the U.S. – with a pair exceptions. Throughout the Prime 25 Markets, the Saturday decline was extra pronounced, and the Thursday improve was higher, whereas Mondays have been stronger for the non-Prime 25 Markets and Thursdays have been weaker.

Room demand bifurcation

For a number of months, we’ve been watching the bifurcation of the trade by way of demand change. Amongst branded motels (chain scales), upper-tier motels (Luxurious, Higher Upscale and Upscale) in mixture haven’t seen a month-to-month demand fall over the previous fifteen months, whereas Economic system motels have fallen every month. The same sample has additionally been seen in 2024 weekly outcomes. This week, solely Economic system noticed a requirement lower, however the decline (excluding the positive aspects seen from the Easter shift) was the smallest of the yr to this point and there’s some proof of a moderation within the downward development.

Market efficiency

Philadelphia, St. Louis, and Washington, D.C.; posted double-digit, YoY RevPAR positive aspects throughout all days. New York Metropolis and Phoenix additionally posted double-digit will increase this week with many of the development coming from weekday and shoulder days.

Exterior the Prime 25 Markets, August, GA; posted a double-digit RevPAR improve, boosted by the closeout of the Masters Golf Match on Sunday. Additionally posting double-digit RevPAR positive aspects have been Buffalo, NY, and Gatlinburg, TN, lifted by strong weekend efficiency, together with Indianapolis and Albany, NY, seeing sturdy efficiency all week.

Whereas the crowds have been nonetheless vital (100K+) over the 2 weekends of Coachella, motels within the Palm Springs submarket noticed all KPIs lower. RevPAR over Friday and Sunday of the primary weekend fell 15.7% in comparison with the identical weekend one in 2023, as a result of a lower in occupancy (-6.6ppts) and ADR (-9%). Weekend one ADR was US$49 with occupancy of 83%. Weekend two, which usually sees decrease resort efficiency, was extra impacted with RevPAR dropping 24% from a yr in the past, with falling occupancy and ADR (-9.9ppts and -14.2%, respectively). Observe, weekend two efficiency is an estimate as information for Sunday, 21 April is preliminary, nonetheless, Friday and Saturday confirmed comparable outcomes to the prelim Sunday determine.

Group demand reached the best stage since October 2023

Conventions and conferences are driving motels with group demand at Luxurious and Higher Upscale motels reaching the best stage because the fall group season and simply 3.8% under the post-pandemic all-time excessive. In comparison with 2019, group demand was 7.5% under the best week recorded in that yr. Group ADR was additionally sturdy, up 4.3% YoY. Over the previous 16 weeks of 2024, weekly group ADR elevated 12 instances, with 11 weeks rising above the speed of inflation.

The sturdy RevPAR positive aspects seen this week in St. Louis and Philadelphia have been pushed partly by group demand, as these markets noticed the most important group occupancy positive aspects of the Prime 25 Markets (together with Dallas). St. Louis additionally posted double-digit ADR will increase. Further markets posting double-digit group ADR positive aspects have been Los Angeles, Detroit, and Washington, D.C.

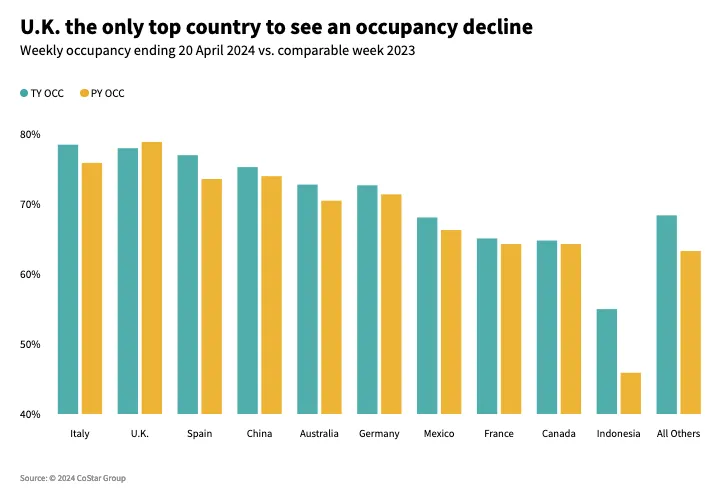

World efficiency sturdy and strengthening

World occupancies outdoors of the U.S. continued to develop. The biggest acquire final week was Indonesia, up +9.1ppts to 55.0%. ADR for the nation fell barely (-2.3%) as all markets throughout the nation confirmed a decline. That is attributable to the shifting nature of Ramadan, which was two weeks earlier this yr.

Among the many largest nations, Italy had the best occupancy (up 3.4ppts to 78.5%), which will be attributed to the start of the worldwide artwork occasion, La Biennale. ADR in Italy rose 22.4%, leading to a 26.4% RevPAR acquire. In Venice, the place the occasion takes place, ADR soared (+126%) with occupancy rising 10.2ppts to 82.1%. The Italian Northeast market situated close by equally benefited from the occasion, with occupancy up 5.6ppts and ADR rising 11%.

Leisure journey additionally confirmed indicators of blooming as Sardinia, Italy, noticed occupancy develop 17.5ppts, whereas ADR jumped 31.1%. Nevertheless, market occupancy was nonetheless low (at 44.2%) given it’s early within the season. One other key leisure nation, Spain, grew occupancy (+3.4ppts to 77.0%) with its largest will increase coming from the Mediterranean Coast and Canary Islands, up 9.8ppts and 9.0ppts, respectively.

The U.Ok. was the one key nation with a slight occupancy decline (-0.9ppts) this week, attributable to the shifting faculty holidays round Easter. Consequently, RevPAR was flat (-0.2%). The UK nonetheless had the second highest occupancy of any key nation this week (78%).

Wanting forward

Normalization stays the principle theme of the trade as its strikes by way of Q2. The primary 16 weeks of the yr present RevPAR positive aspects at an analogous stage seen within the final half of 2023. Wanting forward, positive aspects in group, weekday, and worldwide inbound demand will offset among the softness seen on the weekends as they sluggish. Moreover, numerous indicators (rising debt, delinquencies, inflation, and so forth.) proceed to level to slower leisure journey this yr, particularly in middle-to-lower revenue households. One idea is that we’re seeing a shift from “revenge” to “selective” journey, with company changing into extra discriminating given the upper dwelling prices. One-time occasions akin to graduations, weddings, and live shows could carry extra weight than the annual summer time trip.

Exterior of the U.S., the trade will see additional strengthening, with the 2024 Paris Olympics set for July, rising worldwide journey, and Taylor Swift’s Eras tour driving the positive aspects. Outbound U.S. vacationers, nonetheless, are anticipated to sluggish, however that isn’t evident simply but.

This text initially appeared on STR.