By no means wager towards Bob Iger (or James Cameron, however he’s not related for the needs of this put up). After a number of tough quarters and a turnaround course of that hasn’t been almost as easy as anticipated, the 2024 fiscal first-quarter earnings name was Classic Bob. This put up shares a few of the big-picture outcomes and why they matter, earlier than turning our consideration to Walt Disney World, Disneyland, and the remainder of the Parks & Resorts division.

Disney had an enormous beat on earnings, reporting a lot better than anticipated outcomes. Earnings per share have been $1.22, versus the 99 cents anticipated by Wall Road. Income was about flat at $23.55 billion, in contrast with $23.51 billion within the year-ago quarter. The primary quantity clearly far surpassed expectations, whereas the income quantity truly fell barely quick. Nonetheless, that’s solely a part of the image–as Disney narrowed its losses significantly.

To that time, internet earnings rose to $1.91 billion, up from $1.28 billion within the prior-year interval. That’s largely because of the corporate’s cost-cutting measures–Disney mentioned it’s on tempo to satisfy or exceed its aim of at the least $7.5 billion in financial savings by the top of fiscal 2024. Streaming can be beginning to choose up some slack, as Disney’s direct-to-consumer (DTC) unit reported a $138 million loss within the quarter ($216 million as soon as together with ESPN+, which is a part of a unique division now). That’s nonetheless some huge cash, nevertheless it’s additionally to be anticipated–and an enormous enchancment from $1.05 billion loss within the prior-year interval.

Much more notable are Disney’s forward-looking expectations. The corporate acknowledged that it expects fiscal 2024 earnings per share of about $4.60, which might be at the least 20% greater than the final fiscal 12 months. Disney expects to generate round $8 billion in free money circulation for the fiscal 12 months.

In consequence, Disney elevated its dividend by 50% versus the final dividend paid in January, to $0.45 a share. That is nonetheless solely about half of the 2019 dividend, however a marked enchancment over the previously-suspended ($0.00) dividend beneath the Chapek regime. In equity, that occurred for good purpose, as theme parks and theaters have been closed and the corporate was making huge investments to scale up streaming.

Different massive information is that the board authorized plans for as much as $3 billion in share repurchases. It will mark Disney’s first buyback program since 2018 fiscal 12 months. Actually, I may do with out this (and the dividend, for that matter). I’m not categorically against buybacks, however view them as a extra acceptable means of returning capital to shareholders when there aren’t higher avenues for development. Disney has loads of paths to development–however the inventory arguably is undervalued, so there’s additionally that.

Regardless, the numbers alone and Disney’s plans ought to silence the refrain of critics who preserve chirping, “Disney is bRoKe!” (Who am I kidding, they’ll discover one thing else–or declare that the numbers are fudged or contort this to color it as dangerous information. How dare I dispute the knowledge of random YouTube ragebaiters?!)

Wall Road definitely sees these as robust outcomes from Disney. Shares instantly jumped 7% in after-market buying and selling after the outcomes. As of the time of this put up on February 8, 2024), Disney is up 12% on the day. It wasn’t simply the numbers themselves, although. It was a variety of new bulletins meant geared toward thrilling followers and shareholders, whereas additionally delivering a transparent imaginative and prescient for the longer term that will silence the critics. On this case, not the randos on YouTube–however the activist buyers who’re waging proxy fights.

Earlier than the earnings name even started, Bob Iger appeared on CNBC to interrupt the information that Disney is taking a $1.5 billion stake in Fortnite studio Epic Video games. We’re massive followers of this announcement, which shouldn’t be shocking to common readers provided that 2 weeks in the past we referred to as video video games the corporate’s greatest blind spot and one thing that ought to be remedied ASAP earlier than acquisition prices improve additional.

Suffice to say, Disney wants the mindshare of youthful audiences and that is the proper technique to accomplish that. I personally have zero curiosity in Fortnite or an adjoining Disney-universe, however I can acknowledge its affect and recognition–and that not every little thing must be geared toward me. This can be a massive deal for the way forward for Disney and the longevity and model consciousness of those characters.

Disney additionally introduced that it’ll launch its flagship ESPN streaming service in Fall 2025. This isn’t to be confused with the currently-existing ESPN+ streaming service or the brand new sports activities streaming three way partnership ‘bundle’ that includes Fox, Warner Bros. Discovery, and ESPN coming later this 12 months that was introduced the day earlier than the earnings name.

When you’re questioning why we haven’t lined that information in a standalone put up, it’s as a result of I’m truthfully undecided what to make of it. As a sports activities client and cord-cutter, I’m blissful to lastly have Fox Sports activities with out utilizing my mother-in-law’s cable login (don’t inform anybody). I believe it’s most likely additionally good for Disney and Warners, however each even have their scaled-back streaming variations of their very own networks (Max has B/R now).

I’m skeptical as to how ‘massive’ this will likely be, and assume that largely relies upon upon value. If it finally ends up being over $40 monthly, how many individuals is it going to draw who don’t have already got cable or one thing like YouTube TV? There’s additionally the very actual chance of client confusion as soon as there are 3 totally different ESPN-adjacent apps available on the market. So I believe the jury remains to be out on this. (What actually must occur is sports activities rights contracts want a reality-check. These numbers will not be sustainable in a non-growth setting, besides as loss leaders.)

Along with this, Iger shared extra information in regards to the upcoming movie slate and shared a few surprises. The Moana collection that had been in improvement for Disney+ is going to be launched theatrically as Moana 2. In a nod to Steve Jobs, he delivered an “…and yet one more factor” announcement that Taylor Swift’s The Eras Tour live performance movie is coming to Disney+.

A whole lot of this most likely gained’t resonate with Walt Disney World or Disneyland followers, nevertheless it was an avalanche of bulletins that sign the top of the ‘course-correction’ and begin of a brand new section of growth. Once more, it was Classic Bob, sounding just like the CEO of 2019 and earlier. Lastly.

Though none of this pertains to parks straight, the oblique ramifications are large. As we’ve mentioned repeatedly, all of Disney’s woes are related to future Walt Disney World and Disneyland growth as a result of fixing the issues is a vital prerequisite to development. Properly, mission (at the least partially) completed.

Turning to Parks & Resorts, the information is pretty acquainted. Disney’s new “Experiences” division noticed a 7% bump in income to $9.13 billion, which was an all-time file. Disney Parks & Resorts additionally set all-time information for working earnings and working margin within the first quarter, thanks largely to the well-received openings of World of Frozen at Hong Kong Disneyland and the Zootopia land at Shanghai Disneyland.

This got here regardless of a lower in working earnings on the home parks, which was largely offset by greater outcomes at Disney Cruise Line. Decrease leads to the present quarter in comparison with the prior-year quarter have been resulting from a lower at Walt Disney World Resort reflecting a modest lower in revenues and better prices. Walt Disney World noticed additional decreases in attendance and occupied room nights, each of which mirrored the robust comparability to the fiftieth Anniversary and interval of pent-up demand within the prior-year quarter.

Different headwinds have been greater prices resulting from inflation, partially offset by value saving initiatives and decrease depreciation. There was additionally one other improve in per visitor spending resulting from greater common ticket costs, partially offset by decrease common every day room charges (resulting from considerably improved discounting).

Outcomes at Disneyland Resort have been akin to the prior-year quarter as income development was largely offset by a rise in prices. These impacts have been attributable to elevated visitor spending primarily resulting from greater common ticket costs, continued attendance development, and better prices pushed by inflation. Development at Disney Cruise Line was resulting from will increase in common ticket costs and passenger cruise days, partially offset by greater prices.

Once more, all of that is unsurprising and acquainted to anybody who has listened to the final 3 earnings calls or learn these recaps. Disneyland and Disney Cruise Line proceed to outperform Walt Disney World, which the corporate has beforehand attributed to each “lapping” the fiftieth Anniversary and in addition Florida seeing earlier pent-up demand than California or cruising, and thus it really fizzling out sooner. There may be the expectation, at the least with Disneyland, that this lagged pent-up demand will begin exhausting itself someday this 12 months. (If it occurs on a timeline akin to Walt Disney World, anticipate it to happen in April.)

Some have interpreted this to imply that Walt Disney World is struggling or that the parks are going to be “lifeless” in consequence. It’s arduous to inform whether or not that is purposefully in dangerous religion, however that’s not correct (in any respect). Walt Disney World is down as in comparison with 2022…when revenge journey was off the charts, discounting was minimal, and the fiftieth Anniversary–underwhelming as it’d’ve been to longtime followers–was a marketable and main draw.

Walt Disney World remains to be means up as in comparison with 2019, the final 12 months when issues have been “regular.” It’d be like bettering from .500 one 12 months to going undefeated and successful the Tremendous Bowl to “solely” ending 12-5 however nonetheless successful the Tremendous Bowl within the following 12 months. That third 12 months wasn’t pretty much as good because the second, positive, nevertheless it was nonetheless a incredible end result particularly contemplating the primary 12 months. Such is the story of Walt Disney World and, hopefully, the Detroit Lions.

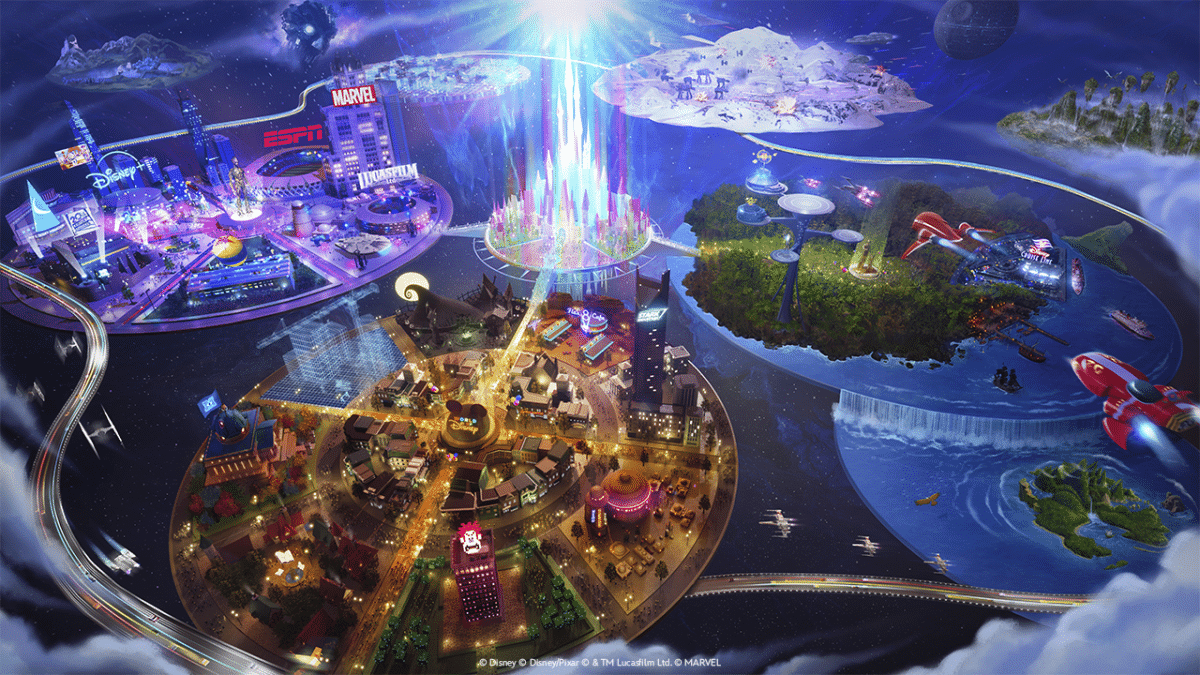

Extra apparently are a few of the forward-looking remarks in the course of the ready feedback and the Q&A. Earlier within the name, the brand new CFO Hugh Johnston mentioned that Disney plans to speculate roughly $60 billion into the enterprise over the subsequent 10 years, “of which roughly 70% is earmarked for incremental capability increasing investments across the globe.”

Requested for extra commentary about that in the course of the questions, Bob Iger mentioned the next: “We’re already arduous at work at principally figuring out the place we’re going to position our new investments and what they are going to be. You’ll be able to just about conclude that they’ll be throughout, which means each single one in all our places would be the beneficiary of elevated funding and, thus, elevated capability, together with on the excessive seas, the place we’re presently constructing three extra ships.”

Iger added: “I’m not going to essentially offer you way more of a way of timing, besides that we’re arduous at work at getting this stuff principally conceived and constructed. And we’ve obtained a menu of issues that may principally begin opening in 2025, and there’ll be a cadence yearly of extra funding and elevated capability.”

This tells us greater than we already know, however solely barely. The analyst who requested the query particularly requested a couple of fifth gate at Walt Disney World, saying there’s been hypothesis about one. That’s a bit, uh, curious as there actually hasn’t. Not less than, not credible hypothesis. Disney has steered repeatedly and constantly that the plan is to construct out the prevailing gates ‘past the berms’ and even the blue sky daydreaming displays this. (See Why a fifth Theme Park Will NOT Be Constructed at Walt Disney World within the Subsequent Decade for additional commentary.)

In any case, 70% of this $60 billion going in direction of capacity-expanding investments is nice information. For these questioning what this implies, it ought to counsel that Disney goes to concentrate on constructing new lands and sights (and cruise ships) fairly than refurbishing present issues or spending cash on placemaking. But it surely’s most likely a bit extra sophisticated than that surely.

Reimagining Splash Mountain to Tiana’s Bayou Journey isn’t capacity-expanding. Neither is redoing Rock ‘n’ Curler Coaster Starring Aerosmith right into a theoretical ‘Taylor’s Model’ of the trip or one set in Wakanda. Nonetheless, the overhauls from Maelstrom to Frozen Ever After or Ellen’s Vitality Journey to Cosmic Rewind arguably have been capacity-expanding for EPCOT, as a result of they took underutilized capability (which means rides that have been dispatching with empty seats) and transformed them into much more standard ones.

The identical may very well be mentioned for a undertaking just like the Sunshine Plaza to Buena Vista Road conversion at Disney California Journey. In isolation, that didn’t broaden the capability of the park. However in mixture, the entire DCA overhaul considerably elevated attendance and thereby utilization of the park.

The EPCOT Central Backbone overhaul, alternatively, didn’t improve capability until you’re evaluating the 2024 model of that space to the 2021 model, which was a sea of partitions. Nonetheless, an replace to the Play Pavilion (or no matter it finally ends up being referred to as) could be added capability because it hasn’t been an attraction in ages.

The purpose is that the definition of capacity-expanding is a bit nebulous and open to (Disney’s) interpretation of what which means. In any case, it undoubtedly doesn’t simply imply a bunch of name new lands and rides. Along with the entire above, it may additionally imply new accommodations and Disney Trip Membership additions–these broaden capability of the Parks & Resorts, too. C’mon, you didn’t actually assume we aren’t getting extra resorts…proper?! I totally anticipate to be setting foot in Reflections Lodge, or no matter it finally ends up being referred to as, inside the subsequent 5 years.

All of this bears mentioning, I believe, as a result of what we’re going to see within the first half of the last decade goes to be pretty heavy on reimaginings, no matter these remarks. Zootopia within the Tree of Life, Indiana Jones Journey changing DINOSAUR, and different yet-to-be-announced transformations. (As I’ve mentioned earlier than, my cash is on Rock ‘n’ Curler Coaster being subsequent up, and probably Journey into Creativeness.)

That is nearly essentially the case if Bob Iger’s remark about an annual cadence is appropriate. We’ve all seen how “shortly” Disney builds new lands and sights. Even when building began in the present day on a Villains Lair past Huge Thunder (it gained’t), the opening date wouldn’t be till 2027 on the absolute earliest. In contrast, they might shut DINOSAUR in direction of the top of this 12 months or early 2025 and have Indiana Jones Journey prepared by 2026. Regardless of the plan is for Rock ‘n’ Curler Coaster may very well be completed even sooner.

None of this ought to be an enormous shock. Iger beforehand indicated that the $60 billion in spending on Parks & Resorts over the subsequent 10 years could be backloaded. Josh D’Amaro has made feedback that they need to develop the footprints of the parks whereas additionally bettering utilization inside them. We’re completely going to get reimaginings–and a few of these will depend as elevated/improved capability. Simply need to mood expectations a bit right here.

Personally, I nonetheless assume this can be a pretty constructive tidbit. That 70% of $60 billion remains to be a reasonably excessive quantity, and we additionally know that $17 billion of that’s earmarked for Walt Disney World. After accounting for inflation, that’s about on par with the last decade that introduced us Pandora, Toy Story Land, Star Wars: Galaxy’s Edge, Cosmic Rewind, and TRON Lightcycle Run.

Additionally in that very same decade, untold sums have been spent on street and different infrastructure work in addition to (figuratively and actually) dumped right into a pit at EPCOT. It wouldn’t shock me within the least if the quantity spent on issues that didn’t broaden capability at Walt Disney World over the past decade was above 40%.

Additionally, we must always need to see some trip reimaginings. If completed proper, who amongst us doesn’t need an up to date Spaceship Earth or Journey into Creativeness (the latter most likely counts as capacity-expanding to some extent, as it could go from a walk-on a part of the time to having an hour wait)?!

Finally, this was an excellent earnings name not simply in seeing Classic Bob and the Walt Disney Firm beginning to get again on observe and constructing once more, but additionally what this implies for the way forward for Parks & Resorts. I do know that’s most likely going to be an unpopular opinion amongst jaded followers who need splashy theme park information commensurate with the opposite bulletins, and I additionally know I’m extra bullish than the common fan who has been burned earlier than and is now (understandably) in wait and see mode.

Nonetheless, I additionally assume my expectations are appropriately tempered (see above), and I’m enjoying the lengthy recreation. A pair extra quarters like this, and the stage is ready for a fully colossal 2024 D23 Expo. One with greater than only a bunch of “what ifs?” or daydreaming–and as a substitute precise concrete bulletins and timelines. In fact, that assumes all goes nicely with the proxy fights and Iger’s turnaround continues at its present trajectory. The previous looks as if a positive factor after this earnings name, whereas the latter is much much less sure. Time will inform, I suppose.

Planning a Walt Disney World journey? Study accommodations on our Walt Disney World Resorts Evaluations web page. For the place to eat, learn our Walt Disney World Restaurant Evaluations. To economize on tickets or decide which kind to purchase, learn our Suggestions for Saving Cash on Walt Disney World Tickets put up. Our What to Pack for Disney Journeys put up takes a singular take a look at intelligent objects to take. For what to do and when to do it, our Walt Disney World Experience Guides will assist. For complete recommendation, the very best place to begin is our Walt Disney World Journey Planning Information for every little thing it’s essential to know!

YOUR THOUGHTS

What do you consider Walt Disney Firm’s first quarter 2024 earnings and future forecast? Shocked that Disney outperformed expectations on earnings per share and is growing the dividend and buybacks in consequence? What about per visitor spending at Walt Disney World and Disneyland, or different theme park outcomes? Excited that 70% of the “turbocharged” funding of $60 billion in Parks & Resorts will likely be on capacity-expansions? Do you agree or disagree with our evaluation? Any questions we will help you reply? Listening to your suggestions–even while you disagree with us–is each attention-grabbing to us and useful to different readers, so please share your ideas under within the feedback!